|

|

|

|

|

|

EGG‑NEWS.com

Egg Industry News, Comments & More by

Simon M.Shane

|

|

|

|

|

|

|

Egg Industry Statistics and Reports

Updated January 2026 USDA Projection for U.S. Egg Production and Consumption.

|

01/16/2026 |

|

On January 16th 2026 the USDA Economic Research Service (ERS) issued actual values for egg production during 2024 with an updated projection for 2025 and a forecast for 2026. Production, consumption and prices were revised from the previous December 15th 2025 report. On January 16th 2026 the USDA Economic Research Service (ERS) issued actual values for egg production during 2024 with an updated projection for 2025 and a forecast for 2026. Production, consumption and prices were revised from the previous December 15th 2025 report.

Projected egg production for 2025 was adjusted downward from 7,737 million dozen in 2024 by 4.8 percent to 7,366 million dozen due to progressive depletion of hen flocks as a result of HPAI. Heavy losses occurred during Q1 2025 with incident cases extending through December totaling 42.3 million hens for the year. The per capita consumption of shell eggs and liquids combined for 2025 will be 259.2 eggs, down 11.4 egg equivalents (-4.2 percent) from 2024. The projected average 2025 benchmark New York bulk unit price was raised 70 cents per dozen over 2024 to 374 cents per dozen. On January 16th the price was 72 cents per dozen reflecting both increased supply and depressed consumption in that market. Subsequent USDA projections will provide greater clarity on the recovery in consumption in an economy that is undergoing inflation in all food categories with the outstanding exception of eggs, even with retailers maintaining high margins and failing to pass on savings to consumers.

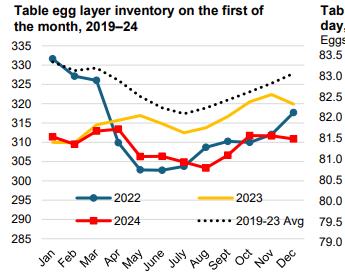

Restoration in flock size after HPAI depletions in 2022 progressed at a net rate of approximately 1.0 million per week offset by losses due to depopulation. Placements were limited by the availability of pullet chicks and for some producers, by the rate of conversion to alternative housing systems. Restoration of the national flock was compromised by a resurgence of HPAI with 40.0 million layers depleted during 2024 but with replacement averaging 24 million pullets per month. On December 31st the total egg-producing flock was estimated by USDA to be 301 million hens, 25  million or 7.7 percent below the nominal flock averaging 326 million hens during 2021 before the onset of the ongoing HPAI epornitic. Effective January 16th the total national flock attained 300.0 million, approximately 26 million (-8.0 percent) below the pre-HPAI level. The productive flock was estimated by the USDA to be 293.4 million on January 14th. Cage-free flocks during December attained 140 million or 46.6 percent of the total. In the January report the Egg Industry Center confirmed a total flock of 302.8 million at the end of December 2025. Unpredictable factors affecting flock size and hence price will include consumer demand as influenced by recently lower shelf prices for generic eggs and the extent of possible losses during the early winter months of the current year. million or 7.7 percent below the nominal flock averaging 326 million hens during 2021 before the onset of the ongoing HPAI epornitic. Effective January 16th the total national flock attained 300.0 million, approximately 26 million (-8.0 percent) below the pre-HPAI level. The productive flock was estimated by the USDA to be 293.4 million on January 14th. Cage-free flocks during December attained 140 million or 46.6 percent of the total. In the January report the Egg Industry Center confirmed a total flock of 302.8 million at the end of December 2025. Unpredictable factors affecting flock size and hence price will include consumer demand as influenced by recently lower shelf prices for generic eggs and the extent of possible losses during the early winter months of the current year.

Exports of eggs and products at approximately 1.8 percent of total production over the first ten months of 2025 attained 104.5 million dozen shell-egg equivalents. This was offset by imports of 108.7 shell egg-equivalents. Exports did not materially affect the domestic price. The U.S. is currently a net importer of egg products and shell eggs for breaking amounting to 4.2 million shell-egg equivalents. Future export volume will be encouraged by low domestic prices and bthe the needs of importing nations but will be constrained by international competition and disease-related embargos.

The USDA forecast for 2026 includes production of 7,900 million dozen, up an optimistic 7.2 percent from 2025. Projected consumption will be 273.7 eggs per capita. This forecast presumes substantial control of HPAI and an adequate supply of replacement chicks and pullets. These are both speculative assumptions in the absence of approved vaccination in high-risk areas. The increase, if it were to become reality would depress the NY Large benchmark price to an average of $1.20 per dozen compared to the 2025 value of $3.73 per dozen for conventional Large white-shelled product in cartons.

Updated January 2024 USDA data is shown in the table below:-

|

Parameter

|

2022*

(actual)

|

2023

(actual)

|

2024*

(actual)

|

2025*

(projection)

|

% Difference

2024-2025

|

|

2026

(forecast)

|

|

|

|

|

|

|

|

|

|

|

Production (million dozen)

|

7,825

|

7,864

|

7,737

|

7,366

|

-4.7

|

|

7,900

|

|

Consumption (eggs per capita)

|

280.5

|

279.3

|

270.6

|

259.2

|

-4.2

|

|

273.7

|

|

New York price (c/doz.)

|

282

|

192

|

303

|

373

|

+23.1

|

|

120

|

*Data influenced by HPAI losses.

Sourcs: Livestock, Dairy and Poultry Outlook released January 16th 2026

|

Trade in Shell Eggs and Products, January through October 2025.

|

01/09/2026 |

|

The volume of exports of shell eggs and products is conditioned by the domestic needs of importers, price against competitors and regulatory disease and logistic restraints. Imports are determined by domestic needs with reduced supply due to flock depopulation as the principal driving factor during the first 10 months of 2025.

USAPEEC data reflecting volume of exports for shell eggs and egg products are shown in the table below comparing 2024 with 2025:-

|

PRODUCT

|

Jan.-Oct. 2024

|

Jan.-Oct. 2025

|

Difference

|

|

Shell Eggs

|

|

|

|

|

Volume (m. dozen)

|

69.8

|

57.6*

|

-12.2 (-17.4%)

|

|

Value ($ million)

|

160.7

|

244.3

|

+83.6 (+52%)

|

|

Unit Value ($/dozen)

|

2.30

|

4.24

|

+1.94 (+84.3%)

|

|

Egg Products

|

|

|

|

|

Volume (metric tons)

|

21,276

|

17,348

|

-3,928 (-18.5%)

|

|

Value ($ million)

|

96.0

|

90.9

|

-5.1 (-5.3%)

|

|

Unit Value ($/metric ton)

|

4,512

|

5,240

|

+928 (+16.1%)

|

U.S. EXPORTS OF SHELL EGG AND EGG PRODUCTS DURING

JANUARY-OCTOBER INCLUSIVE IN 2025 COMPARED WITH 2024

*The data published by USDA for shell eggs are slightly different from USAPEEC figures included in this table.

For the ten-month period Canada was the export destination of 71.3 percent of U.S. shell eggs followed by the Caribbean at 14.7 percent. For egg products the four major importers collectively comprised 78.4 percent of volume with the relative proportions represented by Japan (28.3%); Canada, (15.7%), Mexico, (16.7%) and the EU, (17.7%). For the ten-month period Canada was the export destination of 71.3 percent of U.S. shell eggs followed by the Caribbean at 14.7 percent. For egg products the four major importers collectively comprised 78.4 percent of volume with the relative proportions represented by Japan (28.3%); Canada, (15.7%), Mexico, (16.7%) and the EU, (17.7%).

According to the USDA Egg Markets Overview, January 9th, shell eggs exported over 10 months attained 50.2 million dozen. This represents the average production of 2.5 million hens or 1.6 percent of the current population of producing hens. All egg products including liquid and dried, attained 54.3 million dozen shell equivalents for a total of 104.5 million dozen shell equivalents over ten months. Imports over the same period comprised 70.1 million dozen shell eggs for breaking and 38.5 million dozen shell egg equivalents over all product forms for a total of 108.7 million dozen shell equivalents

Net trade deficit was therefore 4.2 million dozen shell equivalents

The trade situation during 2026 will be influenced by the needs of importers, a fluid tariff situation, landed price and availability. Since supply has increased in volume with a sharp decrease in domestic price, imports will be curtailed with an expectation of higher exports consistent with a more competitive situation.

|

USDA Cage-Free Production Data for December 2025

|

01/05/2026 |

|

The USDA Cage-Free Report covering December 2025, was released on January 2nd 2026, the first edition since October 1st 2025 covering September

The report documented the complement of hens producing under the Certified Organic Program to be 20.9 million (rounded to 0.1 million), up 0.9 million hens or 4.5 percent since September 2025. The number of hens classified as cage-free (but excluding Certified Organic) and comprising aviary, barn and other systems of housing apparently increased by 2.9 million hens or 2.7 percent from September 2025 to 119.5 million, attributed to expansion, transition from conventional cages and repopulation of depleted flocks.

Extensive depopulation was carried out as a result of HPAI through the fourth quarter of 2024 and continuing in January and February 2025 (31 million), but with lower intensity in March (0.2 million) and April (1.0 million) and a single large complex in Arizona during May (3.8 million). Losses reemerged during late September in a caged-bird complex in Wisconsin (3.1 million hens and 250,000 pullets). Additional depopulations occurred in October, (2.2 million); November, 0.5 million and December, (0.2 million).

Average weekly production for Certified Organic eggs in December 2025 was up 5.1 percent percent (rounded) compared to September 2025 with a high average weekly production of 83.3 percent. Average weekly flock production for cage-free flocks other than Certified Organic was up 2.7 percent in December 2025, with a high average hen-month production of 82.1 percent. Seasonally placed flocks in anticipation of periods of peak demand increase the availability of cage-free and organic eggs, reflecting pullet chick placements 20 weeks previously.

There is no adequate explanation for the elevated production rates recorded other than the high proportion of young hens reaching peak placed in anticipation of December demand. It is also assumed that almost all cage free flocks are in the first cycle of production with negligible molting contributing to the high average in hen-week values compared to caged hens.

Due to the Federal shutdown and temporary cessation of the USDA Egg Markets Overview and available data from the weekly USDA Shell Egg Demand Indicator, the categorization of U.S. flocks according to housing system for December was unavailable among the assumed 290 million producing hens. The breakdown will be provided when data is released.

Losses attributed to HPAI in 2025 comprised:-

Caged flocks, 24.8 million representing 8.4 percent of a nominal 290 million producing hens

Cage-free flocks, 17.6 million representing 5.9 percent of the national flock

Organic flocks, negligible, >0.1 percent

|

Average Flock Size

(million hens)

|

Average

December 2025

|

Average

Q3- 2025

|

Average

Q2- 2025

|

Average

Q1 –

2025

|

Average

Q4 –

2024

|

Average

Q3-

2024

|

|

Certified Organic

|

20.9

|

20.0

|

20.0

|

20.4

|

20.5

|

20.0

|

|

Cage-Free Hens

|

119.5

|

115.6

|

108.4

|

103.4

|

104.5

|

103.9

|

|

Total Non-Caged

|

140.4

|

135.6

|

128.4

|

123.8

|

125.0

|

123.9

|

|

Average Weekly Production (cases of 360 eggs)

|

September

2025

|

December

2025

|

|

Certified Organic @ 83.3% hen/day

|

322,370

|

338,683 +5.1%

|

|

Cage-Free @ 82.1% hen/day

|

1,857,403

|

1,908,273 +2.7%

|

|

All Non-Caged @ 82.3% hen/day

|

2,179,773

|

2,246,956 +3.0%

|

On December 29th USDA recorded the following National inventory levels expressed in 30-dozen cases (rounded) with the change from September as a percentage of the total quantity of eggs:-

Commodity shell eggs of all sizes. 1,516,800. (-2.7%)

Commodity breaking stock. 404,100. (+17.5%)

Specialty eggs. 45,500. (+16.3%)

Certified organic eggs. 86,900. (-2.6%)

Cage-Free eggs 425,700. (-3.0%) equivalent to 1.5 days production

|

Average Nest Run Contract Price Cage-Free

White and Brown combined for December

|

$1.73/doz.* (unchanged from May)

|

|

December 2025 Range:

|

$1.55 to $2.10/doz. (unchanged from May)

|

|

FOB Negotiated December price, grade-ready quality, loose nest-run. Price range $1.00 to $2.45 per dozen

|

Average December 2025 Value of $1.10/doz. ($1.43/doz. September 2025)

|

*Essentially a meaningless value

|

Average December 2025 advertisedpromotional National Retail Price C-F, Large Brown

|

$3.43/doz. Dec. 2025 (5 regions)

(Was $3.41/doz. In September 2025)

|

|

USDA Based on 6 ‘Lower 48’ Regions, 1,646 stores

SW, NW, NE, SE, MW & SC.

|

Range $3.99/doz. (NW) to $2.50/doz. (SW)

|

Negotiated nest-run grade-ready cage-free price for December 2025 averaged $0.88 per dozen, down $0.59 per dozen (-40.1 percent) from $1.47 per dozen in September 2025, reflecting a disturbance in balance between demand and supply.

The December 2025 advertised U.S. featured retail price for Large White cage-free eggs over 1,646 ‘Lower 48’ stores in six regions (NW, NE, SE, SW, MW and SC.) was $2.63 per dozen. This compares with 1,182 stores featuring cage-free Large White in September and reflects more promotions as the year has progressed, consistent with lower demand and increased production. The Decenber 2025 advertised U.S. featured retail price for Large Brown cage-free eggs over 2,819 stores in six regions was $3.43 per dozen with a range of $2.50 per dozen in the SC region to $4.09 per dozen in the SW region. The average promotional shelf price was only 3 cents per dozen above September for this category

The recorded average gradeable nest run price of $0.88 per dozen for brown and white cage-free combined plus a provision of $0.60 cents per dozen for packaging, packing and transport, resulted in a theoretical price of $1.48 per dozen delivered to CDs. The average advertised promotional retail prices of $3.43 per dozen for Brown and $2.63 per dozen for white represented retail margins of 131 percent for featured Brown and 77 percent for White respectively. Fewer promotions were offered for White compared to Brown cage-free by stores reflecting the balance between supply and demand for the two broad categories. Margins are presumed higher for non-featured eggs including pastured and other specialty eggs at shelf prices attaining in excess of $8.00 per dozen in high-end supermarket chains. Retailers are maximizing margins especially on Certified Organic, free-range and pastured categories restricting the volumes of sales, of all categories ultimately disadvantageous to producers and consumers.

|

REVIEW OF NOVEMBER 2025 EGG PRODUCTION COSTS

|

12/15/2025 |

|

This update of U.S egg-production costs and available prices is provided for the information of producers and stakeholders. Statistical data was unavailable for October and November due to the Federal shutdown and has yet to be updated. December figures will hopefully be available for inclusion in the January edition. September values for production and November cost and price updates provided by the EIC are included in this review

NOVEMBER HIGHLIGHTS

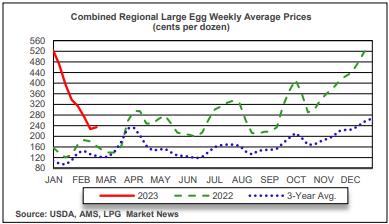

- November 2025 USDA ex-farm blended USDA nest-run, benchmark price for conventional eggs from caged hens was 181 cents per dozen, up 64 cents per dozen or 54.7 percent from the October 2025 value of 117 cents per dozen. The corresponding November 2023 and 2024 values were respectively $1.63 and $3.64 cents per dozen. For annual comparison, average monthly USDA benchmark price over 2023 was 146 cents per dozen compared to 247 cents per dozen covering 2024. Stock levels and prices prior to the onset of flock depletions due to HPAI indicated a relative seasonal balance between supply and demand. Future nest-run and wholesale prices will be largely dependent on consumer demand for shell eggs and products, as determined by the economy, supply as influenced by flock placements, re-emergence of HPAI, net imports and the rate of replacement of pullets and hens depleted. Other considerations include diversion to shell sales from the egg-breaking sector in an interconnected industry. Imports of shell eggs continued during the past three months with the cumulative negative trade balance attaining 24.5 million dozen shell equivalents through August. During August the negative trade balance in shell eggs amounted to 4.0 million dozen. For 2025 through August, U.S. liquid and dried products combined achieved a positive trade balance of 5.6 million with August rising to 2.1 million dozen shell egg equivalents. (It is noted that Brazil released export data covering shell eggs in November during mid-December)

- November 2025 USDA ex-farm negotiated USDA nest-run, benchmark price for all categories of cage-free eggs was not released. The September 2025 value was147 cents per dozen. The corresponding November 2023 and 2024 values were respectively 123 and 455 cents per dozen.

- Fluctuation in wholesale price is attributed in part to the amplification of upward and downward swings associated with the commercial benchmark price-discovery system in use. An important factor influencing pricing is the proportion of shell eggs supplied under cost-plus contracts accentuating the upward and downward price trajectory of uncommitted eggs as determined by the price discovery system. Highly pathogenic avian influenza was the major driver of price in 2024 and through Q1 of 2025 due to the high incidence rate. Approximately 40 million hens and at least 2.0 million pullets were depleted in 2024 with close to an additional 36 million birds, (hens and pullets) in 35 complexes or farms through mid-May 2025. The Fall 2025 losses involved complexes of 3.1 million hens in late September and 2.0 million in early October. During November 570,000 hens producing table eggs were depopulated on 22 farms in close geographic proximity with flock losses averaging 24,000 per case suggesting contract producers of cage free eggs with common risk factors including feed supply and egg collection. This trend is a departure from losses involving a few very large complexes evident in the wave of cases during early fall.

- November 2025 USDA average nest-run production cost for conventional eggs from caged flocks over four regions (excluding SW and West), applying updated inputs was 75.7 cents per dozen, up 1.9 cents from October 2025 at 73.8 cents per dozen. The November average nest run production cost for other than caged and certified organic hens was estimated by the EIC to be 95.3 cents per dozen up 2.2 cents per dozen from October. Approximately 60 cents per dozen should be added to the USDA benchmark nest-run costs to cover processing, packing material and transport to establish a realistic cost value as delivered to warehouses.

- November 2025 USDA benchmark nest-run margin for conventional eggs attained a positive value of 105.3 cents per dozen compared to a positive margin of 43.2 cents per dozen in October 2025. Year to date the average monthly nest-run production margin has attained 255.9 cents per dozen. Average nest-run monthly margin for 2024 was 170.8 cents per dozen compared to 64.2 cents per dozen in 2023 and 155 cents in 2022.

- November 2025 USDA benchmark nest-run margin for all categories of cage-free eggs could not be ascertained due to non-release of USDA data. In October margin attained a positive value of 40.9 cents per dozen compared to a positive margin of 53.1 cents per dozen in September 2025. Through October the average monthly nest-run production margin attained 321.1 cents per dozen. Average nest-run monthly margin over 2024 was 440 cents per dozen compared with 100 cents per dozen in 2023, relatively unaffected by HPAI compared to the preceding and following years.

Since data for October and November production and September exports was unavailable as of mid-December values for the most recent reported month of August are retained in the following paragraphs.

- The August 2025 national flock (over 30,000 hens per farm) was stated by the USDA to be up by 6.6 million hens (rounded, and a probable undercount) to 285.9 million compared to approximately 326 million before the advent of the H5N1 epornitic of HPAI in 2022. Approximately 3.5 million hens returned to production from molt during the month together with projected maturation of 23 million pullets, with the total offset by depletion of an unknown number of spent hens. On October 8th USDA estimated the total U.S table-egg production flock at 304.5 million with 298.1 million actually in production.

- August 2025 pullet chick hatch of 28.7 million was down 0.4 million (-1.4 percent) from July 2025 but inconsistent with an increased industry need to replace depopulated flocks.

- August September export data will be released after resumption of Federal activities. In July 2025 exports of shell eggs and products combined were up 27.1 percent from June 2025 to 376,600 case equivalents representing the theoretical production of 5.6 million hens. Shell egg exports totaling 72,000 cases were dominated by Canada (38 percent of volume) the “Rest of Americas” including the Caribbean (40 percent). With respect to 304,000 case equivalents of egg products, importers comprised Canada (32 percent of volume), “Rest of Americas and the EU (each 20 percent), Japan, (12 percent), Mexico, (8 percent) collectively representing 98 percent of shipments. Volumes exported are based on the needs of importers, competing suppliers, availability in the U.S. and FOB prices offered.

- According to the USDA Egg Market Overview released on September 8th, all egg imports (shell, liquid and dry) in July attained 19.5 million dozen shell equivalents compared to exports of all categories of 11.2 million dozen shell equivalents.

- For 2025 through July the negative trade balance in all shell and derived egg products attained 15.5 million dozen shell equivalents.

|

TABLES SHOWING KEY PARAMETERS FOR NOVEMBER 2025.

Summary tables for the latest USDA November 2025 costs and unit prices were made available by the EIC on December 9th 2025. Data is arranged, summarized, tabulated and compared with values from the previous November 7th 2025 release reflecting October 2025 costs and production data, as revised and applicable. Monthly comparisons of production data and costs are based on revised USDA and EIC values.

VOLUMES OF PRODUCTION REFLECTING THE ENTIRE INDUSTRY

|

PARAMETER

|

SEPTEMBER 2025

|

NOVEMBER 2025*

|

|

Table-strain eggs in incubators

|

55.0 million (Sept.)

|

million (Nov.)

|

|

Pullet chicks hatched

|

28.7 million (Aug.)

|

million (Oct)

|

|

Pullets to be housed 5 months after hatch

|

25.9 million (Feb. ‘26)

|

million (Mar ’26)

|

|

EIC 2025 December 1st U.S. total flock projection

|

316.7 million (Sept.)

|

million (Oct.)

|

|

National Flock in farms over 30,000

|

285.9 million (Aug.)

|

million (Sept.)

|

|

National egg-producing flock

|

299.0 million (Aug.)

|

308.7 million (Dec)1

|

|

Cage-free flock excluding organic

Cage-free organic flock

|

116.6 million (Sept.)

20.0 million (Sept.)

|

million (Nov.)

million (Nov.)

|

|

Proportion of flocks in molt or post-molt

|

11.9% (Sept)

|

% (Nov.)

|

|

Total of hens in National flock, 1st cycle (estimate)

|

253.4 million (Aug.)

|

million (Nov.)

|

*USDA data unavailable

- From USDA Weekly Shell-egg Demand Indicator December 10th

|

Total U.S. Eggs produced (billion)

|

7.59 August 2025

|

NOVEMBER 2025

|

|

Total Cage-Free hens in production

Proportion of organic population

|

136.6 million (Sept.)

14.6% Organic

|

million (Nov.)

% Organic

|

|

“Top-5” States hen population (USDA)1

|

141.8 million (Aug.)

|

million (Nov.)

|

*Revised USDA/EIC Note 1. Texas excluded to maintain confidentiality

PROPORTION OF U.S. TOTAL HENS BY STATE, 2025

Based on a nominal denominator of 285 million hens in flocks over 30,000 covering 95 percent of the U.S complement.

USDA has amended inclusion of specific states in regions and eliminated Texas data to protect confidentiality of Company flock

Sizes

|

STATE

|

AUGUST1

2025

|

November

2025

|

|

Iowa

|

15.3%

|

%

|

|

Indiana

|

12.2%

|

%

|

|

Ohio

|

12.5%

|

%

|

|

Pennsylvania

|

8.0%

|

%

|

|

Texas (estimate)

|

8.3% ?

|

%?

|

|

California

|

1.7%

|

%

|

- Values rounded to 0.1%

Rate of Lay, weighted hen-month (USDA) 81.5 September 2025. % November 2025

*Revised USDA

|

Revised per capita

|

Egg consumption 2020

|

285.6 (down 7.8 eggs from 2019)

|

|

Revised per capita

|

Egg consumption 2021

|

282.5 (down 3.1 eggs from 2020)

|

|

Actual per capita

|

Egg consumption 2022

|

280.5 (down 2.0 eggs from 2021 due to HPAI)

|

|

Actual per capita

|

Egg consumption 2023

|

278.0 (down 2.5 eggs from 2022)

|

|

Actual per capita

Forecast per capita

Projection per capita

|

Egg consumption 2024

Egg consumption 2025

Egg consumption 2026

|

270.6 (down 7.2 eggs from 2023) attributed to HPAI losses*

261.0 (down 9.6 eggs from 2024) forecast adjusted for HPAI losses , was 258.2 last month but this was aspirational

276.4 (up 18.4 eggs from 2025 assuming restoration of flocks and without HPAI losses)

|

*Revised, using data from USDA Livestock, Dairy and Poultry Outlook September 18th 2025 taking into account demand from the food service sector and presumably including the effect of HPAI depopulation and net importation.

EGG INVENTORIES AT BEGINNING OF SEPTEMBER 2025:

|

Shell Eggs

|

1.59 million cases in December down 6.4 percent from September 20251

|

|

Frozen Egg

Products

|

514,960 case equivalents, up 28.0 percent from August 2025

|

|

Dried Egg

Products

|

Not disclosed since March 2020 following market disruption due

To COVID. Moderate levels of inventory are assumed.

|

- USDA Weekly Shell Egg Inventory Report December 15th.

EGGS BROKEN UNDER FSIS INSPECTION (MILLION CASES) AUGUST 2025, 7.03 November 2025,

|

Cumulative eggs broken under FSIS inspection 2024 (million cases)

|

77.2

|

JAN. TO DEC.

|

|

Cumulative 2024: number of cases produced (million)

|

257.9

|

JAN. TO DEC.

|

|

Cumulative 2024: proportion of total eggs broken

|

29.9%

|

(30.8% 2022)

|

| |

|

|

|

Cumulative eggs broken under FSIS inspection 2025 (million cases)

|

52.3

|

JAN.-AUG.

|

|

Cumulative 2025: number of cases produced (million)

|

161.6

|

JAN.-AUG.

|

|

Cumulative 2025: proportion of total eggs broken

|

32.3%

|

JAN.-AUG.

|

Export and import data for August was not released due to Federal shutdown.

EXPORTS JULY 2025: (Expressed as shell-equivalent cases of 360 eggs).

|

Parameter

|

Quantity Exported

|

|

Exports:

|

2025

|

|

Shell Eggs (thousand cases)

|

JUNE 148. JULY 72

|

|

Products (thousand case equivalents)

|

JUNE. 148. JULY. 304

|

|

TOTAL (thousand case equivalents)*

|

JUNE. 296. JULY 376

|

*Representing 1.8 percent of National production in JULY 2025 (0.4% shell, 1.4% products).

COSTS AND UNIT REVENUE VALUES1 FOR CONVENTIONAL EGGS FROM CAGED HENS

|

Parameter

|

NOVEMBER 2025

|

OCTOBER 2025

|

|

4-Region Cost of Production ex farm (1st Cycle)1

|

75.7 c/doz

|

73.8 c/doz

|

|

Low

|

73.7c/doz (MW)

|

71.9 c/doz (MW)

|

|

High

|

77.7 c/doz (NE)

|

75.6c/doz (NE)

|

Notes: 1. Excludes SW and West representing an important deficiency

Components of Production cost per dozen:-

| |

NOVEMBER 2025

|

OCTOBER 2025

|

|

Feed

|

35.0 c/doz

|

33.3c/doz

|

|

Pullet depreciation

|

12.0 c/doz

|

11.8c/doz

|

|

Labor (estimate) plus

|

|

|

|

Housing (estimate) plus

|

28.7c/doz

|

28.7c/doz

|

|

Miscellaneous and other (adjusted May 2023)

|

|

|

Ex Farm Margin (rounded to nearest cent) according to USDA values reflecting November2025:-

181.0 cents per dozen1- 75.7 cents per dozen =105.3 cents per dozen (October 2025 comparison: 117.0 cents per dozen – 73.8 cents per dozen = 43.2 cents per dozen.

Note 1: USDA Blended nest-run egg price

| |

|

NOVEMBER 2025

|

OCTOBER 2025

|

|

USDA

|

Ex-farm Price (Large, White)

|

181.0 c/doz (Nov.)

|

117.0c/doz (Oct.)

|

| |

Warehouse/Dist. Center

|

236.0 c/doz (Nov.)

|

160.0c/doz (Oct.)

|

| |

Store delivered (estimate)

|

242.0 c/doz (Nov.)

|

166.0 c/doz (Oct.)

|

| |

Dept. Commerce Retail1 National

|

349.0 c/doz (Nov.)

|

349.0 c/doz (Oct.)

|

| |

Dept. Commerce Retail1 Midwest

|

363.0 c/doz (Nov.)

|

333.0 c/doz (Oct.)

|

- Unrealistic USDA values based on advertised promotional prices with few participating stores, non-representative of shelf prices!

| |

NOVEMBER 2025

|

OCTOBER 2025

|

|

U.S. Av Feed Cost per ton

|

$226.50

|

$215.59

|

|

Low Cost – Midwest

|

$205.31

|

$195.34

|

|

High Cost – West

|

$265.32

|

$253.05

|

|

Differential

Corn/ton 5 regions

Soybean meal/ton 5 regions

|

$ 60.01

$170.70

$341.51

|

$ 57.71

$165.52

$308.90

|

|

Pullet Cost 19 Weeks

|

$4.66 NOVEMBER 2025

|

$4.58 OCTOBER 2025

|

|

Pullet Cost 16 Weeks

|

$4.10 NOVEMBER 2025

|

$4.04 OCTOBER 2025

|

AVERAGE COSTS AND UNIT REVENUE FOR EGGS FROM CAGE-FREE HENS

|

Parameter

|

NOVEMBER 2025

|

OCTOBER 2025

|

|

5-Region Cost of Production ex farm (1st Cycle)

|

95.3 c/doz

|

93.1 c/doz

|

|

Low

|

91.1c/doz (MW)

|

89.1 c/doz (MW)

|

|

High

|

103.1 c/doz (West)

|

100.6 c/doz (West)

|

Components of Production cost for cage-free eggs, per dozen:-

| |

NOVEMBER 2025

|

OCTOBER 2025

|

|

Feed (non-organic)

|

40.5 c/doz

|

38.6 c/doz

|

|

Pullet depreciation

|

15.8 c/doz

|

15.6 c/doz

|

|

Labor (estimate) plus

|

|

|

|

Housing (estimate) plus

|

39.0c/doz

|

38.9 c/doz

|

|

Miscellaneous and other

|

|

|

Ex Farm Margin (rounded to cent) according to USDA values reflecting negotiated price for OCTOBER 2025:- (November not disclosed)

Cage-Free brown 134.0 cents per dozen1- 93.1 cents per dozen = 40.9 cents per dozen

September 2025:- 147.0 cents per dozen - 93.9 cents per dozen = 53.1 cents per dozen

| |

|

NOVEMBER 2025

|

OCTOBER 2025

|

|

USDA

|

USDA Average Ex-farm Price1

Gradable nest run2

|

173 c/doz (Nov.)

c/doz. (Nov.)

|

173 c/doz (Oct .)

c/doz. (Oct.)

|

| |

Warehouse/Dist. Center3

|

c/doz (Nov.)

|

c/doz (Oct.)

|

| |

Store delivered (estimate)

|

c/doz (Nov.)

|

c/doz (Oct.)

|

| |

Dept. Com. Retail4 C-F White

Dept. Com. Retail4 C-F Brown

|

562 c/doz (Nov.)

675 c/doz (Nov.)

|

c/doz (Oct.)

c/doz (Oct.)

|

| |

Dept. Com. Retail3 Organic

Dept. Com. Retail3 Pasture

|

568 c/doz (Nov.)

646 c/doz (Nov.)

|

570 c/doz (Oct.)

661 c/doz. (Oct.)

|

Contract price, nest-run loose. Range 155 to 210 c/doz. Negligible change since July 2024 and totally unrealistic.- Negotiated price, loose. Range $1.20 to $2.60 per dozen

- Estimate based on prevailing costs

- Unrealistic USDA values based on promotional prices with few participating stores and non-representative of shelf prices

Cage-Free HPAI losses unknown during November

|

Cage-Free* Pullet Cost 19 Weeks

|

$5.66 NOVEMBER 2025

|

$5.57 OCTOBER 2025

|

|

Cage-Free* Pullet Cost 16 Weeks

|

$4.95 NOVEMBER 2025

|

$4.89 OCTOBER 2025

|

* Conventional (non-organic) feed

Feed prices used are the average national and regional values for caged flocks. Excludes organic feeds with prices substantially higher than conventional.

|

USDA-WASDE REPORT #666. December 9th 2025

|

12/09/2025 |

|

OVERVIEW

Understandably the December 9th edition of the World Agriculture Supply and Demand Estimates (WASDE) #666 was little changed with respect to corn and soybeans from the post-shutdown November 18th edition reflecting the 2025 crop. Crop size and ending stocks were derived from actual harvest data, projections for domestic use and the effect of tariff policy and competition that influence export volumes Understandably the December 9th edition of the World Agriculture Supply and Demand Estimates (WASDE) #666 was little changed with respect to corn and soybeans from the post-shutdown November 18th edition reflecting the 2025 crop. Crop size and ending stocks were derived from actual harvest data, projections for domestic use and the effect of tariff policy and competition that influence export volumes

The December WASDE report reconfirmed that the 2025 corn crop was harvested from an expanded 90.0 million acres, (82.7 million acres in 2024). The soybean crop was harvested from a reduced 80.3 million acres, (86.3 million acres in 2024).

The December WASDE yield value for the 2025 corn crop was retained at 186.0 bushels per acre, unchanged from November. By comparison corn yield was 183.1 bushels per acre in 2024. Soybean yield was held at 53.0 bushels per acre, unchanged from November reflecting harvest data. By comparison soybean yield was 51.7 bushels per acre for the previous 2024 crop.

The December WASDE projection for the ending stock of corn was lowered by 5.8 percent from November to 2,029 million bushels. The December USDA projection for the ending stock of soybeans was unchanged from November at 290 million bushels consistent with domestic use and export projections. The December WASDE projection for the ending stock of corn was lowered by 5.8 percent from November to 2,029 million bushels. The December USDA projection for the ending stock of soybeans was unchanged from November at 290 million bushels consistent with domestic use and export projections.

The December WASDE retained the projected corn price for the 2025-2026 market year at an average of 400 cents per bushel. The projected average season price for soybeans was held at 1,050 cents per bushel. The price of soybean meal was unchanged from November at $300 per ton.

USDA commodity prices suggest higher feed costs for livestock and poultry producers especially if promised exports materialize. Farmers including corn growers will then benefit from increased prices. In some areas return from corn will be below break-even given relative yields, production costs and depressed per bushel prices. The USDA has announced an allocation of $12 billion to row-crop farmers to compensate for prolonged low commodity prices resulting from reduced exports occasioned by tariffs imposed by the U.S.

Projections for world output included in the December 2025 WASDE report, reflect the most recent estimates for the production and export of commodities especially in the Southern Hemisphere with an emphasis on volumes and prices offered by Argentine and Brazil. Economists also considered the impact of weather patterns arising from the La Nina event especially on South America.

It is accepted that USDA projections for exports will be influenced by the fluid situation relating to tariffs. Estimates of exports are also based on the perceived intentions and needs of China. This Nation sharply curtailed purchases of commodities and especially U.S. soybeans during the 2024-2025 market year and the current year to date.

CORN

Production parameters for corn were unchanged from the November WASDE, reflecting actual harvest data and updated projections for domestic use and trade. The December WASDE Report projected a 2025 crop of 16,752 million bushels, compared to 15,413 million bushels for the previous 2024 record harvest. The “Feed and Residual” category was unchanged from September at 6,100 million bushels. The Food and Seed category was projected at 1,380 million bushels. The Ethanol and Byproducts Category was retained at 5,600 million bushels consistent with estimated demand for E-10 and higher blends for driving needs in late fall and winter months. Projected corn exports were raised 4.1 percent to 3,300 million bushels, based on recent orders and shipments. The anticipated ending stock of corn will be 2,029 million bushels or 11.1 percent of projected availability.

The forecast USDA average season farm price for corn in the December WASDE report was 400 cents per bushel. At close of trading after the noon November 14th release of the WASDE, the CME spot price for corn was 448 cents per bushel, 12.0 percent above the USDA projection but unchanged from the November 18th CME price.

DECEMBER 2025 WASDE #666 Summary for the 2025 Corn Harvest:

|

Harvest Area

|

90.0 million acres

|

(98.7 m. acres planted, with harvest corresponding to 91.2% of acres planted)

|

|

Yield

|

186.0 bushels per acre

|

(Updated from 186.7 bushels per acre in the Sept. WASDE)

|

|

Beginning Stocks

|

1,532 m. bushels

|

|

|

Production

|

16,752 m. bushels

|

|

|

Imports

|

25 m. bushels

|

|

|

Total Supply

|

18,309 m. bushels

|

Proportion of Supply

|

|

Feed & Residual

|

6,100 m. bushels

|

33.3%

|

|

Food & Seed

|

1,380 m bushels

|

7.5%

|

|

Ethanol & Byproducts

|

5,600 m. bushels

|

30.6%

|

|

Domestic Use

|

13,080 m. bushels

|

71.4%

|

|

Exports

|

3,200 m. bushels

|

17.5%

|

|

Ending Stocks

|

2,029 m. bushels

|

11.1%

|

Average Farm Price: 400 cents per bushel. (Unchanged from the December WASDE)

SOYBEANS

Projections for soybeans were retained from the November WASDE, with a 2025 yield of 53.0 bushels per acre but with a reduced area of 81.1 million acres planted compared to 2024. The December WASDE retained the soybean crop at 4,254 million bushels. Crush volume was held from November at 2,555 million bushels despite recently increased industry capacity. Projected exports were held at 1,635 million bushels despite the prospect of increased imports by China following uncertainty over tariffs and diplomatic conflict. Ending stocks were anticipated to be 290 million bushels, unchanged from the November WASDE. Prior to 2018, China, the largest trading partner for U.S. agricultural commodities, imported the equivalent of 25 percent of U.S. soybeans harvested.

The December USDA WASDE projection for the ex-farm price for soybeans was unchanged from November at 1,050 cents per bushel. At close of trading on December 9th following the noon release of the WASDE, the CME spot price was 1,088 cents per bushel, 3.6 percent above the December USDA projection and 3.5 percent below the November 18th CME price. The December USDA WASDE projection for the ex-farm price for soybeans was unchanged from November at 1,050 cents per bushel. At close of trading on December 9th following the noon release of the WASDE, the CME spot price was 1,088 cents per bushel, 3.6 percent above the December USDA projection and 3.5 percent below the November 18th CME price.

DECEMBER 2025 WASDE #666 Summary for the 2025 Soybean Harvest:-

|

Harvest Area

|

80.3 million acres

|

81.1 m. acres planted. Harvest corresponding to 99.0% of planted acreage)

|

|

Yield

|

53.0 bushels per acre

|

(Updated from 53.5 bushels/acre in the September WASDE)

|

|

Beginning Stocks

|

316 m. bushels

|

|

|

Production

|

4,254 m. bushels

|

|

|

Imports

|

20 m. bushels

|

|

|

Total Supply

|

4,590 m. bushels

|

Proportion of Supply

|

|

Crush Volume

|

2,555 m. bushels

|

55.7%

|

|

Exports

|

1,635 m. bushels

|

35.6%

|

|

Seed

|

73 m. bushels

|

1.6%

|

|

Residual

|

37 m. bushels

|

0.8%

|

|

Total Use

|

4,300 m. bushels

|

93.7%

|

|

Ending Stocks

|

290 m. bushels

|

6.3%

|

Average Farm Price: 1,050 cents per bushel (Unchanged from November)

SOYBEAN MEAL

The projected parameters for soybean meal were retained from the November WASDE. Production will attain 60.2 million tons, consistent with the unchsnged soybean crush volume of 2,555 million bushels. Projected production reflects the stagnant demand for biodiesel despite expanded U.S. crushing capacity. Crush volume is driven both by exports and domestic consumption for livestock feed and for soy oil supplying the food and biodiesel segments. The projection of domestic use was 41.7 million tons. Exports were estimated at 19.2 million tons.

The USDA projected the ex-plant price of soybean meal at $300 unchanged from the November WASDE as an average for the season based on supply and demand considerations. USDA predicted an ending stock of 475,000 tons representing 0.8 percent of supply.

At close of trading on December 9th the CME spot price for soybean meal was $301 per ton, up $1 per ton (0.3 percent) compared to the December WASDE projection of $300 per ton and down 8.2 percent from the November 18th CME price.

DECEMBER 2025 WASDE #666 Projection of Soybean Meal Production and Use

|

Beginning Stocks

|

450

|

|

Production

|

60,225

|

|

Imports

|

675

|

|

Total Supply

|

61,350

|

|

Domestic Use

|

41,675

|

|

Exports

|

19,200

|

|

Total Use

|

60,875

|

|

Ending Stocks

|

475

|

(Quantities in thousand short tons)

Average Price ex plant:$300 per ton (Unchanged from the November WASDE)

IMPLICATIONS FOR PRODUCTION COST

The price projections based on CME quotations for corn and soybeans suggest higher feed production costs for broilers and eggs. Going forward, prices of commodities will be determined by World supply and demand and U.S. domestic use and exports.

For each 10 cents per bushel change in corn:-

- The cost of egg production would change by 0.45 cent per dozen

- The cost of broiler production would change by 0.25 cent per live pound

For each $10 per ton change in the cost of soybean meal:-

- The cost of egg production would change by 0.35 cent per doze

- The cost of broiler production would change by 0.30 cent per live pound.

WORLD SITUATION

With respect to world coarse grains and oilseeds the December 2025 WASDE Report included the following appraisals by USDA:-

COARSE GRAINS:

“Global coarse grain production for 2025/26 is forecast down slightly to 1.576 billion tons. The

2025/26 foreign coarse grain outlook is for lower production, trade, and higher ending stocks

relative to last month. Foreign corn production is cut with declines for Ukraine, Canada,

Nigeria, Indonesia, and Senegal partially offset by increases for the EU, Russia, and

Zimbabwe. Ukraine corn production is sharply lower with reductions to both area and yield

based on reported government data to date, where harvest has been slow as a result of wet

conditions in key growing areas. Canada corn is reduced based on the latest information

from Statistics Canada. The EU is raised reflecting increases for Spain, Hungary, Romania,

and Poland. Foreign barley production is higher with increases for Canada, the EU, and

Australia”.

“Corn exports for 2025/26 are raised for the United States but lowered for Ukraine. Corn

imports are higher for Colombia with cuts for the EU and Zimbabwe. Barley exports are

raised for Australia, Canada, and the EU while Ukraine is reduced. Foreign corn ending

stocks are higher based on an increase for Argentina partly offset by declines for Ukraine

and Canada. Global corn stocks, at 279.2 million tons, are down 2.2 million”.

OILSEEDS:

“Global oilseed production for 2025/26 is raised this month, driven mainly by higher rapeseed, peanut, and soybean production, partially offset by lower sunflowerseed output. Global rapeseed production is raised 3.0 million tons, with increases for Canada, Australia, and Russia. Canada has the largest increase, up 2.0 million tons to a record 22.0 million, based on the latest Statistics Canada report. Higher rapeseed production is mostly offset by lower global sunflowerseed production, down 2.5 million tons on harvest results for Ukraine and Russia. Current and historical peanut production is raised for Nigeria on official area data. “Global oilseed production for 2025/26 is raised this month, driven mainly by higher rapeseed, peanut, and soybean production, partially offset by lower sunflowerseed output. Global rapeseed production is raised 3.0 million tons, with increases for Canada, Australia, and Russia. Canada has the largest increase, up 2.0 million tons to a record 22.0 million, based on the latest Statistics Canada report. Higher rapeseed production is mostly offset by lower global sunflowerseed production, down 2.5 million tons on harvest results for Ukraine and Russia. Current and historical peanut production is raised for Nigeria on official area data.

The 2025/26 global soybean outlook includes higher production, increased crush, lower exports, and raised ending stocks.”

“Global soybean production is increased 0.8 million tons to 422.5 million, reflecting higher crops for Russia and India but lower output for Canada and Ukraine. Global soybean crush for 2025/26 is increased 0.3 million tons to 365.2 million, mainly on higher supplies in Russia and India. Global soybean exports are lowered 0.3 million tons on lower shipments for Ukraine and Benin. Imports are reduced for Japan, Russia, and Saudi Arabia but raised for Brazil. Global soybean ending stocks are increased 0.4 million tons to 122.4 million, mainly on higher stocks for Brazil and Russia”.

World and U.S. Data Combined for Coarse Grains and Oilseeds:-

|

Factor: Million m. tons

|

Coarse Grains

|

Oilseeds

|

|

Output

|

1,576*

|

690

|

|

Supply

|

1,898

|

832

|

|

World Trade

|

249

|

215

|

|

Use

|

1,588

|

578

|

|

Ending Stocks

|

310

|

144

|

*Values rounded to one million metric ton

(1 metric ton corn= 39.37 bushels. 1 metric ton of soybeans = 36.74 bushels)

(“ton” represents 2,000 pounds)

|

USDA-WASDE REPORT #664, September 12th 2025

|

09/12/2025 |

|

OVERVIEW

The USDA provided updated projections for the production of corn and soybeans in the September 12th World Agriculture Supply and Demand Estimates (WASDE) #664, reflecting the 2025 crop. Production values for corn and soybeans were updated from previous editions. Projections of crop size and ending stocks are derived from acreage planted, recent annual crop yields, the latest crop progress reports, data relating to domestic use and predictions of the effect of tariff policy and competition that influence exports. The USDA provided updated projections for the production of corn and soybeans in the September 12th World Agriculture Supply and Demand Estimates (WASDE) #664, reflecting the 2025 crop. Production values for corn and soybeans were updated from previous editions. Projections of crop size and ending stocks are derived from acreage planted, recent annual crop yields, the latest crop progress reports, data relating to domestic use and predictions of the effect of tariff policy and competition that influence exports.

The September WASDE report confirmed that the 2025 corn crop will be harvested from an expanded 90.0 million acres, (82.7 million acres in 2024). The soybean crop will be harvested from a reduced 80.3 million acres, (86.3 million acres in 2024).

The September WASDE yield value for the 2025 corn crop was predicted at 186.7 bushels per acre, down 1.1 percent from 188.8 bushels per acre noted in August. By comparison yield was 183.1 bushels per acre in 2024. The projected value for soybean yield was an optimistic 53.5 bushels per acre down 0.2 percent from August. By comparison yield was 51.7 bushels per acre for the previous 2024 crop.

As of September 7th the USDA Crop Progress Report documented 95 percent of the corn crop had attained the dent stage, 25 percent was mature and 4 percent had been harvested. With respect to condition, 65 percent was classified as “good” or “excellent” combined, compared to 64 percent for the corresponding week in 2024. The September 8th Report confirmed that 97 percent of the soybean crop had set pods and 21 percent was dropping leaves. With respect to condition, 64 percent was classified as “good” or “excellent” combined, compared to 65 percent for the corresponding week in 2024. As of September 7th the USDA Crop Progress Report documented 95 percent of the corn crop had attained the dent stage, 25 percent was mature and 4 percent had been harvested. With respect to condition, 65 percent was classified as “good” or “excellent” combined, compared to 64 percent for the corresponding week in 2024. The September 8th Report confirmed that 97 percent of the soybean crop had set pods and 21 percent was dropping leaves. With respect to condition, 64 percent was classified as “good” or “excellent” combined, compared to 65 percent for the corresponding week in 2024.

The September WASDE projection for the ending stock of corn was reduced 0.3 percent from August to 2,110 million bushels. The September USDA projection for the ending stock of soybeans was up 3.4 percent from August to 300 million bushels due to increased supply and lower exports.

The September WASDE projected the corn price for the 2025-2026 market year at an average of 390 cents per bushel. The projected average season price for soybeans was reduced 10 cents to 1,000 cents per bushel. The price of soybean meal was unchanged from August at $280 per ton. USDA commodity prices suggest stable to lower feed costs for livestock and poultry producers. Row crop farmers and especially corn growers will experience declining margins. In some areas corn will be below break-even given relative production costs and per bushel prices. It is probable that high support prices will be required if importing nations respond negatively to tariffs proposed by the Administration.

Projections for world output included in the September 2025 WASDE report, reflect the most recent estimates for the production and export of commodities especially in the Southern Hemisphere with an emphasis on Argentine and Brazil. Economists also considered the impact of weather patterns arising from the La Nina event especially on South America.

It is accepted that USDA projections for export will be influenced by the fluid situation relating to tariffs. Exports are also based on the perceived intentions and needs of China. This Nation has sharply curtailed purchases of commodities and especially U.S. soybeans during the 2024-2025 and current market year.

CORN

Production parameters for corn were updated from the August WASDE, influenced by data on crop progress, actual acreage planted and trade figures. The September WASDE Report projected a 2025 crop of 16,815 million bushels, compared to 15,413 million bushels for the previous 2024 record harvest. The “Feed and Residual” category was unchanged from August to 6,100 million bushels. The Food and Seed category was projected at 1,380 million bushels. The Ethanol and Byproducts Category was retained at 5,600 million bushels consistent with estimated demand for E-10 and higher blends for driving needs in fall months. Projected corn exports were raised 3.5 percent to 2,975 million bushels, based on recent orders and shipments. The anticipated ending stock of corn will be 2,110 million bushels or 11.6 percent of projected availability. Production parameters for corn were updated from the August WASDE, influenced by data on crop progress, actual acreage planted and trade figures. The September WASDE Report projected a 2025 crop of 16,815 million bushels, compared to 15,413 million bushels for the previous 2024 record harvest. The “Feed and Residual” category was unchanged from August to 6,100 million bushels. The Food and Seed category was projected at 1,380 million bushels. The Ethanol and Byproducts Category was retained at 5,600 million bushels consistent with estimated demand for E-10 and higher blends for driving needs in fall months. Projected corn exports were raised 3.5 percent to 2,975 million bushels, based on recent orders and shipments. The anticipated ending stock of corn will be 2,110 million bushels or 11.6 percent of projected availability.

The forecast USDA average season farm price for corn in the September WASDE report was 390 cents per bushel. At 16H00 EDT on September 12th after the noon release of the WASDE, the CME spot price for corn was 428 cents per bushel, 9.7 percent above the USDA projection and 8.6 percent above the August 12th CME price.

SEPTEMBER 2025 WASDE #664 Projections for the 2025 Corn Harvest:

|

Harvest Area

|

90.0 million acres

|

(98.7 m. acres planted, with harvest corresponding to 91.2% of acres planted)

|

|

Yield

|

186.7 bushels per acre

|

(Updated from 188.8 bushels per acre in the Aug. WASDE)

|

|

Beginning Stocks

|

1,325 m. bushels

|

|

|

Production

|

16,815 m. bushels

|

|

|

Imports

|

25 m. bushels

|

|

|

Total Supply

|

18,165 m. bushels

|

Proportion of Supply

|

|

Feed & Residual

|

6,100 m. bushels

|

33.6%

|

|

Food & Seed

|

1,380 m bushels

|

7.6%

|

|

Ethanol & Byproducts

|

5,600 m. bushels

|

30.8%

|

|

Domestic Use

|

13,080 m. bushels

|

72.0%

|

|

Exports

|

2,975 m. bushels

|

16.4%

|

|

Ending Stocks

|

2,110 m. bushels

|

11.6%

|

Average Farm Price: 390 cents per bushel. (unchanged from August WASDE)

SOYBEANS

Production parameters for soybeans were updated from the August WASDE, influenced by crop progress data and acreage planted. The September WASDE Report projected a 2025 yield of 53.5 bushels per acre but with reduced acreage planted compared to 2024. The September WASDE projected the soybean crop to be 4,301 million bushels. Crush volume was increased only 0.6 percent from August to 2,555 million bushels despite recently increased industry capacity. Projected exports were reduced 1.2 percent to 1,685 million bushels based on the prospect of reduced imports by China following uncertainty over tariffs and diplomatic conflict. Ending stocks were anticipated to be 300 million bushels, up 3.5 percent from the August WASDE. Prior to 2018, China, the largest trading partner for U.S. agricultural commodities, imported the equivalent of 25 percent of U.S. soybeans harvested. Production parameters for soybeans were updated from the August WASDE, influenced by crop progress data and acreage planted. The September WASDE Report projected a 2025 yield of 53.5 bushels per acre but with reduced acreage planted compared to 2024. The September WASDE projected the soybean crop to be 4,301 million bushels. Crush volume was increased only 0.6 percent from August to 2,555 million bushels despite recently increased industry capacity. Projected exports were reduced 1.2 percent to 1,685 million bushels based on the prospect of reduced imports by China following uncertainty over tariffs and diplomatic conflict. Ending stocks were anticipated to be 300 million bushels, up 3.5 percent from the August WASDE. Prior to 2018, China, the largest trading partner for U.S. agricultural commodities, imported the equivalent of 25 percent of U.S. soybeans harvested.

The USDA WASDE September projection for the ex-farm price for soybeans was reduced 10 cents per bushel from August to 1,000 cents per bushel. At 16H00 EDT on September 12th following release of the WASDE, the CME spot price was 1,045 cents per bushel, 4.5 percent above the September USDA projection and 1.3 percent above the August 12th CME price.

SEPTEMBER 2025 WASDE #664 Projection for the 2025 Soybean Harvest:-

|

Harvest Area

|

80.3 million acres

|

81.1 m. acres planted. Harvest corresponding to 99.0% of planted acreage)

|

|

Yield

|

53.5 bushels per acre

|

(Updated from 53.6 bushels/acre in the Aug. WASDE)

|

|

Beginning Stocks

|

330 m. bushels

|

|

|

Production

|

4,301 m. bushels

|

|

|

Imports

|

20 m. bushels

|

|

|

Total Supply

|

4,651 m. bushels

|

Proportion of Supply

|

|

Crush Volume

|

2,555 m. bushels

|

54.9%

|

|

Exports

|

1,685 m. bushels

|

36.2%

|

|

Seed

|

73 m. bushels

|

1.6%

|

|

Residual

|

34 m. bushels

|

0.8%

|

|

Total Use

|

4,351 m. bushels

|

93.5%

|

|

Ending Stocks

|

300 m. bushels

|

6.5%

|

Average Farm Price: 1,000 cents per bushel (down 10 cents per bushel from August)

SOYBEAN MEAL

The projected parameters for soybean meal were adjusted from August. Production will attain 60.2 million tons, up 0.6 percent consistent with the 0.6 percent increased soybean crush volume of 2,555 million bushels. Projected production reflects the stagnant demand for biodiesel despite expanded U.S. crushing capacity. Crush volume is driven both by exports and domestic consumption for livestock feed and for soy oil supplying the food and biodiesel segments. The projection of domestic use was 41,675 million tons. Exports were estimated at 19.2 million tons.

The USDA projected the ex-plant price of soybean meal at $280 unchanged from the August WASDE as an average for the season based on supply and demand considerations. USDA predicted an ending stock of 475,000 tons representing 0.8 percent of supply.

At 16H00 EDT on September 12th the CME spot price for soybean meal was $288 per ton, up 2.9 percent compared to the September WASDE projection of $280 per ton and down 1.4 percent from the August CME price.

SEPTEMBER 2025 WASDE #664 Projection of Soybean Meal Production and Use

|

Beginning Stocks

|

450

|

|

Production

|

60,225

|

|

Imports

|

675

|

|

Total Supply

|

61,350

|

|

Domestic Use

|

41,675

|

|

Exports

|

19,200

|

|

Total Use

|

60,875

|

|

Ending Stocks

|

475

|

(Quantities in thousand short tons)

Average Price ex plant: $280 per ton )unchanged from August 2025)

IMPLICATIONS FOR PRODUCTION COST

The price projections based on CME quotations for corn and soybeans suggest lower feed production costs for broilers and eggs. Going forward, prices of commodities will be determined by World supply and demand and U.S. domestic yield, use and exports.

For each 10 cents per bushel change in corn:-

- The cost of egg production would change by 0.45 cent per dozen

- The cost of broiler production would change by 0.25 cent per live pound

For each $10 per ton change in the cost of soybean meal:-

- The cost of egg production would change by 0.35 cent per doze

- The cost of broiler production would change by 0.30 cent per live pound.

WORLD SITUATION

With respect to world coarse grains and oilseeds the August 2025 WASDE Report included the following appraisals by USDA:-

COARSE GRAINS:

“Global coarse grain production for 2025/26 is forecast 24.9 million tons higher to 1.572 billion.

This month’s 2025/26 foreign coarse grain outlook is for lower production, trade, and ending

stocks relative to last month. Foreign corn production is down reflecting cuts to the EU and

Serbia that are partially offset by increases for Ukraine and Canada. For the EU and Serbia

extreme heat and dryness in southeastern Europe during the month of July reduces yield

prospects. Area is also lowered for the EU. Ukraine production is raised on greater area. Canada

is higher reflecting an increase in yield expectations. Foreign barley production for 2025/26 is

reduced with a decline for Uruguay”.

“Major global coarse grain trade changes for 2025/26 include higher corn exports for the United

States and Ukraine but reductions for Serbia and the EU. Corn imports are raised for Mexico, the

EU, Egypt, Colombia, and Turkey but lowered for Canada. Foreign corn ending stocks are down,

reflecting declines for China, Indonesia, and the EU that are partly offset by increases for

Ukraine and Egypt. Global corn stocks, at 282.6 million tons, are up 10.4 million”.

OILSEEDS:

“Global 2025/26 oilseed production is lowered 3.3 million tons to 690.1 million mainly on lower “Global 2025/26 oilseed production is lowered 3.3 million tons to 690.1 million mainly on lower

soybean, sunflower seed, and cottonseed production. Global sunflower seed production is

lowered 1.2 million tons to 55.1 million on hot and dry weather conditions leading to lower yields for the EU, Ukraine, Turkey, and Serbia”.

“Global soybean supply and demand forecasts for 2025/26 include lower production, exports, and ending stocks. Global production for 2025/26 is lowered mainly on lower production for the

United States and Serbia. Exports are reduced for the United States but raised for Argentina and

Uruguay. Imports are reduced for the EU, Iran, and Vietnam. Global ending stocks are reduced

1.2 million tons to 124.9 million on lower stocks for Argentina, the EU, Iran, Vietnam, and the

United States.”

World and U.S. Data Combined for Coarse Grains and Oilseeds:-

|

Factor: Million m. tons

|

Coarse Grains

|

Oilseeds

|

|

Output

|

1,573*

|

692

|

|

Supply

|

1,886

|

835

|

|

World Trade

|

245

|

214

|

|

Use

|

1,576

|

580

|

|

Ending Stocks

|

310

|

145

|

*Values rounded to one million metric ton

(1 metric ton corn= 39.37 bushels. 1 metric ton of soybeans = 36.74 bushels)

(“ton” represents 2,000 pounds)

|

Trade in Shell Eggs and Products, January through July 2025.

|

09/06/2025 |

|

The volume of exports of shell eggs and products is conditioned by the domestic needs of importers, price against competitors and regulatory disease and logistic restraints. Imports are determined by domestic needs with reduced supply due to flock depopulation as the principal driving factor during the 1st Quarter of 2025. The volume of exports of shell eggs and products is conditioned by the domestic needs of importers, price against competitors and regulatory disease and logistic restraints. Imports are determined by domestic needs with reduced supply due to flock depopulation as the principal driving factor during the 1st Quarter of 2025.

USAPEEC data reflecting volume of exports for shell eggs and egg products are shown in the table below comparing 2024 with 2025:-

|

PRODUCT

|

Jan.-July 2024

|

Jan.-July 2025

|

Difference

|

|

Shell Eggs

|

|

|

|

|

Volume (m. dozen)

|

45.6

|

44.0*

|

-1.6 (-3.5%)

|

|

Value ($ million)

|

94.5

|

213.6

|

+119.1 (+126%)

|

|

Unit Value ($/dozen)

|

2.07

|

4.85

|

+2.78 (+134%)

|

|

Egg Products

|

|

|

|

|

Volume (metric tons)

|

16,162

|

11,406

|

-4,756 (-29.4%)

|

|

Value ($ million)

|

71.9

|

63.4

|

-8.5 (-11.8%)

|

|

Unit Value ($/metric ton)

|

4,448

|

5,558

|

+1,110 (+25.0%)

|

U.S. EXPORTS OF SHELL EGG AND EGG PRODUCTS DURING

JANUARY-JULY INCLUSIVE IN 2025 COMPARED WITH 2024

*The data published by USDA for shell eggs are slightly different from USAPEEC figures included in this table.

For the seven-month period Canada was the export destination of 72.0 percent of U.S. shell eggs followed by the Caribbean at 19.1 percent. For egg products the four major importers collectively comprised 78.4 percent of volume with the relative proportions represented by Japan (25.2%); Canada, (20.4%), Mexico, (16.6%) and the EU, (16.2%). For the seven-month period Canada was the export destination of 72.0 percent of U.S. shell eggs followed by the Caribbean at 19.1 percent. For egg products the four major importers collectively comprised 78.4 percent of volume with the relative proportions represented by Japan (25.2%); Canada, (20.4%), Mexico, (16.6%) and the EU, (16.2%).

According to the USDA Egg Markets Overview, September 6th, shell eggs exported attained 38.4 million dozen. All egg products including liquid and dried, attained 34.8 million dozen shell equivalents for a total of 73.2 million dozen shell equivalents over seven months. Imports over the same period comprised 58.5 million dozen shell eggs for breaking and 30.2 million dozen shell egg equivalents over all product forms for a total of 88.7 million dozen shell equivalents

Net trade deficit was therefore 15.5 million dozen shell equivalents

The trade situation will be influenced by tariff policy and the needs of importers during the remaining four months of 2025. Since supply will hopefully improve in volume, imports will be curtailed with an expectation of higher exports consistent with more competitive prices.

|

U.S Egg Industry-By the Numbers

|

07/22/2025 |

|

The following production data was summarized from the July 21st 2025 edition of the USDA Chickens and Eggs-:

June 2025 pullet hatch, 29.7 million, up 14 percent from June 2024.

January to June 2025 cumulative pullet hatch, 177.9 million, up 9 percent from first half of 2025

July 1st 2025 egg-type hatching eggs in incubators, 57.3 million, up 14 percent from July 1st 2024

June 2025 pullets placed, 28.3 million, up 6 percent from June 2024

June 2025 pullets undergoing rearing, 129.4 million, up 2 percent from June 2024.

July 1st 2025 hen population 288.1 million, down 5 percent from July 2024.

June 2025 table eggs produced, 7,074 billion, down 6 percent from June 2024.

July 1st 2025 hens in molt, 2.1% of flock, up 17 percent from July 2024.

July 1st 2025 hens completed molt, 9.8% of flock, up 4 percent from July 2024.

June 2025 disposal by slaughter, 12.6 million, up 6 percent from June 2024

June 2025 disposal by rendering, composting or death, 8.3 million, up 48 percent from June 2024.

The take-away from July data is the initiation of a replacement of the national flock that was reduced by depopulation of 39 million hens during the first five months of 2025. It is probable that the quantum of replacements will be consistent with anticipated demand, avoiding oversupply and depressed prices as recorded in 2016 and early 2023. If mortality due to HPAI returns during the fall migration of waterfowl or if extension of infection from dairy herds occurs, growth in the national flock will be impacted.

|

Updated USDA-ERS Poultry Meat Projection

|

06/03/2025 |

|

On June 18th 2024 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2024, a projection for 2025 and a forecast for 2026.

The 2025 projection for broiler production is for 47,500 million lbs. (21.591 million metric tons) up 1.2 percent from 2024. USDA projected per capita consumption of 101.9 lbs. (46.3 kg.) for 2025, up 0.9 percent from 2024. Exports will attain 6,588 million lbs. (2.995 million metric tons), 2.0 percent below the previous year.

The 2026 USDA forecast for broiler production will be 48,100 million lbs. (21.864 million metric tons) up 1.1 percent from 2025 with per capita consumption up 0.7 lb. to 102.6 lbs. (46.6 kg). Exports will be 1.2 percent higher compared to 2025 at 6,670 million lbs. (3.031 million metric tons), equivalent to 14.5 percent of production.

Production values for the broiler and turkey segments of the U.S. poultry meat industry are tabulated below:-

|

Parameter

|

2024

(actual)

|

2025

(projection)

|

2026

(forecast)

|

Difference

2024 to 2025

|

|

Broilers

|

|

|

|

|

|

Production (million lbs.)

|

46,994

|

47,580

|

48,100

|

+1.2

|

|

Consumption (lbs. per capita)

|

101.0

|

101.9

|

102.6

|

+0.9

|

|

Exports (million lbs.)

|

6,724

|

6,588

|

6,670

|

-2.0

|

|

Proportion of production (%)

|

14.3

|

13.8

|

13.9

|

-3.5

|

|

|

|

|

|

|

|

Turkeys

|

|

|

|

|

|

Production (million lbs.)

|

5,121

|

4,806

|

5,080

|

-6.2

|

|

Consumption (lbs. per capita)

|

13.8

|

13.0

|

13.5

|

-5.8

|

|

Exports (million lbs.)

|

486

|

405

|

435

|

-16.7

|

|

Proportion of production (%)

|

9.5

|

8.4

|

8.6

|

-11.6

|

Source: Livestock, Dairy and Poultry Outlook released June 18th 2025

The June USDA report updated projection for the turkey industry for 2025 including annual production of 4,806 million lbs. (2.185 million metric tons), down 6.2 percent from 2024. Consumption in 2025 is projected to be 13.0 lbs. (5.9 kg.) per capita, down proportionately by 5.8 percent from the previous year. Export volume will attain 405 million lbs. (184,090 metric tons) in 2025. Values for production and consumption of RTC turkey in 2025 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, production levels, reduced losses from HPAI and inventories consistent with season.

The 2026 forecast for turkey production is 5,080 million lbs. (2.309 million metric tons) up an optimistic 5.7 percent from 2025 with per capita consumption up an unsubstantiated 3.8 percent to 13.5 lbs. (6.1 kg). Exports will be 19.7 percent higher than in 2025 to 435 million lbs. (197,728 metric tons) equivalent to 8.6 percent of production.

Export projections do not allow for a breakdown in trade relations with existing major partners including Mexico, Canada and China nor the impact of catastrophic diseases including HPAI and vvND in either the U.S. or importing nations

|

Trade in Shell Eggs and Products, Q1, 2025

|

05/14/2025 |

|

The volume of exports of shell eggs is conditioned by the domestic needs of importers, price against competitors and regulatory disease and logistic restraints. Imports are determined by domestic needs with reduced supply due to flock depopulation as the principal driving factor. The volume of exports of shell eggs is conditioned by the domestic needs of importers, price against competitors and regulatory disease and logistic restraints. Imports are determined by domestic needs with reduced supply due to flock depopulation as the principal driving factor.

USDA-FAS data reflecting volume of exports for shell eggs and egg products are shown in the table below comparing 2024 with 2025:-

|

PRODUCT

|

Jan.-March. 2024

|

Jan.-March. 2025

|

Difference

|

|

Shell Eggs

|

|

|

|

|

Volume (m. dozen)