On February 26th, Secretary Rollins announced a “robust strategy to deliver affordable eggs”. A review of the five-point program suggests “more of the same” with the promise of additional money and introduction of a few semantic changes that rise to the level of rearranging deck chairs on the Titanic.

On February 26th, Secretary Rollins announced a “robust strategy to deliver affordable eggs”. A review of the five-point program suggests “more of the same” with the promise of additional money and introduction of a few semantic changes that rise to the level of rearranging deck chairs on the Titanic.

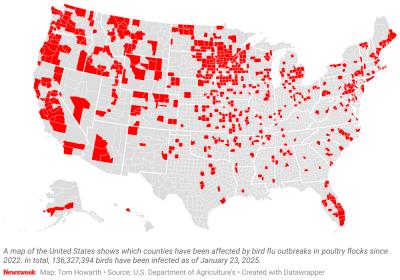

Before considering the components of the program, a review of the past three years of USDA policy denotes their failure to control highly pathogenic avian influenza (HPAI). Depopulation in 2022 attained 43.1 million laying hens, 14.4 million were killed in the succeeding year, 39.7 million in 2024 and approximately 30 million hens have been removed from the national population year-to-date. Despite replacement of approximately 4 million started pullets each month, retention of flocks beyond normal age of depletion and other measures, flock size has fallen from 328 million on February 1st 2021 through 310 million in 2023 declining to 292 million on February 1st 2025.

Reduction in supply affecting both shell eggs and products has resulted in a disproportionate increase in price currently a source of embarrassment to the Administration with a pre-election commitment to reducing food inflation.

Attempts at “stamping out” what is obviously an endemic infection with wild bird reservoirs has proven to be unsuccessful and exceedingly expensive to the public sector. Futile efforts by the USDA have incurred a cost of close to $2.4 billion for indemnity and decontamination. This figure pales in comparison with the cost borne by consumers. The conservative $3 per dozen differential between the pre-HPAI cost compared to the average price in 2024 amounts to $23 billion over the 7.6 billion dozen consumed in either shell or equivalent liquid form.

Attempts at “stamping out” what is obviously an endemic infection with wild bird reservoirs has proven to be unsuccessful and exceedingly expensive to the public sector. Futile efforts by the USDA have incurred a cost of close to $2.4 billion for indemnity and decontamination. This figure pales in comparison with the cost borne by consumers. The conservative $3 per dozen differential between the pre-HPAI cost compared to the average price in 2024 amounts to $23 billion over the 7.6 billion dozen consumed in either shell or equivalent liquid form.

The “five-pronged approach” is little changed from what has preceded the current unsatisfactory situation. USDA will subsidize improvements in structural and operational biosecurity by up to $500 million but will require a 25 percent match by producers. Deployment of laser installations would be a meaningful improvement in biosecurity given current knowledge of how flocks are infected. These installations if positioned and operated continuously have proven effective in preventing congregation of waterfowl. These birds serve as reservoirs of the virus in the vicinity of farms, many of which are located near wetlands or rivers along the major flyways. A second improvement in biosecurity could be the installation of effective commercial vehicle washing installations, especially for feed mills supplying egg production and turkey farms. Accepted structural biosecurity in the form of modules in which employees can shed outer clothing, shower and don farm-provided protective clothing should have been be the responsibility of individual producers. In any event, producers who are at this late stage are now requesting USDA payments to introduce structural biosecurity should be obliged to undertake to repay grants. Progressive producers have invested in improvements notwithstanding the reality that even the most effective structural and operational biosecurity cannot provide absolute protection against windborne virus.

Throwing money at the problem will not solve the problem of too few hens in production. Replacement of flocks is limited by the availability of day-old chicks from a finite number of parent-level breeders. Restoring the national flock in the immediate term is restrained by the biological reality that pullets commence lay at approximately 20 weeks of age. Despite the allocation of $400 million from March through the end of the USDA fiscal year, no specifics were provided on how this sum will increase the number of hens in the national flock.

USDA will assign $100 million for vaccine innovation and other strategies to reduce depopulation. For the edification of Secretary Rollins, vaccines proven to be effective are available off the shelf. Both today and tomorrow. There is considerable published data on the effectiveness of HVT-vector vaccines and for inactivated oil emulsion products. If there is a deficiency with respect to vaccination it relates to production capacity. Given the potential demand for vaccines world-wide, the biologics industry will be willing to invest in expanded capacity providing there are no artificial restrictions intended to delay approval and deployment of commercial products.

When we come down to reality it is evident that the reticence to allow vaccination is a fear over trade embargos that may impact the broiler segment of the industry. The USDA is dancing around the single effective modality to reduce the incidence rate of HPAI outbreaks and to restore production.

Tinkering with cage free restriction and introduction of as yet defined “innovative strategies” or the expedient of importation will have no immediate or intermediate effect on the supply of eggs. Enhanced biosecurity alone is not the answer. Depopulation will continue if the USDA persists in a clearly ineffective strategy to control an endemic infection with a wildlife reservoir.

The possibility of zoonotic infection was an aspect of HPAI that was not considered in the “ Five-pronged Approach”. Neither the U.S. nor the world can afford an H5N1 pandemic given the lessons of COVID. Admittedly the risk is low despite emerging mutations that have allowed mammal-to-mammal transmission of H5N1 virus. To date only a low level of infection of workers in contact with infected flocks and dairy herds has been recorded albeit with less than enthusiastic surveillance. Notwithstanding the frequently repeated “low probability of an emerging epidemic or pandemic”, the consequences would be catastrophic and would reflect adversely on the legacy of the Administration if effective control measures including vaccination of large populations of hens were to be ignored.

The possibility of zoonotic infection was an aspect of HPAI that was not considered in the “ Five-pronged Approach”. Neither the U.S. nor the world can afford an H5N1 pandemic given the lessons of COVID. Admittedly the risk is low despite emerging mutations that have allowed mammal-to-mammal transmission of H5N1 virus. To date only a low level of infection of workers in contact with infected flocks and dairy herds has been recorded albeit with less than enthusiastic surveillance. Notwithstanding the frequently repeated “low probability of an emerging epidemic or pandemic”, the consequences would be catastrophic and would reflect adversely on the legacy of the Administration if effective control measures including vaccination of large populations of hens were to be ignored.

Avian influenza is the Newcastle disease of the 2020s. This infection was catastrophic during the 1970s as HPAI is today. Newcastle disease is effectively suppressed below the outbreak threshold by effective vaccination and is not an impediment to trade in poultry and products.

In the U.s.The USDA should take cognizance of the findings incorporated in the World Organization for Animal Health document Vaccination and Surveillance for HPAI in Poultry: Current Situation and Perspectives, published following the October 22nd 2024, meeting of world experts in Paris.

We have the resources to suppress HPAI applying strict biosecurity coupled with vaccination. This is consistent with the World Organization for Animal Health Terrestrial Animal Health Code supporting vaccination. The WOAH considers that vaccination should facilitate safe trade without increasing the risk of HPAI in poultry and products.

It is time for a radical change in suppressing endemic HPAI. Based on the failure of “stamping out” to control the infection, throwing more money at the situation as in the proposed USDA Five-pronged Approach will not have any meaningful effect on reducing the incidence rate of HPAI or the cost of eggs as denoted by the realities of the past three years.