This update of U.S egg-production statistics, costs and prices is sponsored by Big Dutchman USA for the information of producers and stakeholders

MARCH HIGHLIGHTS

- March 2025 USDA ex-farm blended USDA nest-run, benchmark price for conventional eggs from caged hens was 474 cents per dozen, down 266 cents per dozen or 35.9 percent from the February 2025 value of 740 cents per dozen. The corresponding March 2023 and 2024 values were respectively $2.71 and $1.87 cents per dozen. For annual comparison, average monthly USDA benchmark price over 2023 was 146.0 cents per dozen compared to 247 cents per dozen for 2024. Stock levels and prices prior to the onset of flock depletions due to HPAI indicated a relative seasonal balance between supply and demand. Future nest-run and wholesale prices will be largely dependent on consumer demand for shell eggs and products and the rate of replacement of pullets and hens depleted due to HPAI. Other considerations include diversion to shell sales from the egg-breaking sector in an interconnected industry.

- Fluctuation in wholesale price is attributed in part to the amplification of upward and downward swings associated with the commercial benchmark price-discovery system in use. An additional factor influencing pricing is the proportion of shell eggs supplied under cost-plus contracts accentuating the upward and downward price trajectory of uncommitted eggs. Highly pathogenic avian influenza was the major driver of price with a high incidence rate. Approximately 40 million hens and at least 2.0 million pullets were depleted in 2024 with to 33 million birds, in 32 complexes or farms year to date.

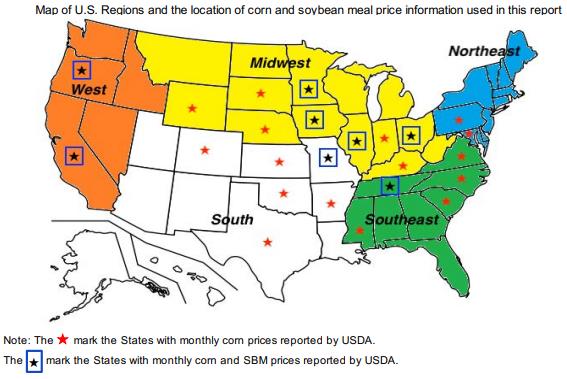

- March 2025 USDA average nest-run production cost for conventional eggs from caged flocks over four regions (excluding SW and West), applying updated inputs was 74.7 cents per dozen, down 1.4 cents from February 2025 at 76.1 cents per dozen. The March average nest run production cost for other than caged hens was estimated by the EIC to be 93.7 cents per dozen down 1.6 cents per dozen from February. Approximately 60 cents per dozen should be added to the USDA benchmark nest-run costs to cover processing, packing material and transport to establish a realistic cost value as delivered to warehouses.

- March 2025 USDA benchmark nest-run margin for conventional eggs attained a positive value of 399.3 cents per dozen compared to a positive margin of 663.9 cents per dozen in February 2025. Average nest-run monthly margin for 2024 was 170.8 cents per dozen compared to 64.2 cents per dozen over 2023 and 155 cents in 2022.

- March 2025 USDA benchmark nest-run margin for all categories of cage-free eggs attained a positive value of 444.3 cents per dozen compared to a positive margin of 820.7 cents per dozen in February 2025. Average nest-run monthly margin over 2024 was 440 cents per dozen compared with 100 cents per dozen in 2023, relatively unaffected by HPAI compared to the preceding and following years.

- The February 2025 national flock (over 30,000 hens per farm) was stated by the USDA to be down 0.5 million hens (rounded and a probable undercount) to 289.5 million compared to the revised January 2025 value of 299.0 million and relative to 326 million before the advent of HPAI in 2022. Approximately 3.5 million hens returned to production from molt in December together with projected maturation of 26 million pullets, with this number offset by depletion of an unknown number of spent hens.

- February 2025 pullet chick hatch of 27.9 million was down 0.4 million (-1.4 percent) from January 2025 despite increased industry requirements to replace depopulated flocks.

- February 2025 exports of shell eggs and products combined were up 15.2 percent from January 2025 to 425,000 case equivalents representing the theoretical production of 5.6 million hens. Shell egg exports totaling 259,000 cases were dominated by Canada (84 percent of volume) and the “Rest of Americas” nations including the Caribbean (13 percent). With respect to 166,000 case equivalents of egg products, Canada (35 percent of volume), Japan, (27 percent), Rest of Americas (15 percent) and Mexico, (9 percent) collectively represented 86 percent of shipments. Volumes exported are based on the needs of importers, competition, availability in the U.S. and FOB prices offered.

|

TABLES SHOWING KEY PARAMETERS FOR MARCH 2025.

Summary tables for the latest USDA March 2025 flock statistics, costs and unit prices made available by the EIC on April 9th 2025 are arranged, summarized, tabulated and compared with values from the previous March 7th 2025 release reflecting February 2025 costs and production data as applicable. Monthly comparisons of production data and costs are based on revised USDA values.

VOLUMES OF PRODUCTION REFLECTING THE ENTIRE INDUSTRY

|

PARAMETER

|

MARCH 2025

|

FEBRUARY 2025

|

|

Table-strain eggs in incubators

|

58.5 million (Mar.)

|

56.4* million (Feb.)

|

|

Pullet chicks hatched

|

27.9 million (Feb.)

|

28.3* million (Jan.)

|

|

Pullets to be housed 5 months after hatch

|

27.5 million (July)

|

24.2* million (June)

|

|

EIC 2025 December 1st U.S. total flock projection

|

314.2 million (Mar.)

|

315.3 million (Feb.)

|

|

National Flock in farms over 30,000

|

273.8 million (Feb.)

|

283.3* million (Jan.)

|

|

National egg-producing flock

|

289.5 million (Feb.)

|

299* million (Jan.)

|

|

Cage-free flock excluding organic

Cage-free organic flock

|

105.4 million (Mar.)

20.4 million (Mar.)

|

103.7* million (Feb.)

20.5 million (Feb.)

|

|

Proportion of flocks in molt or post-molt

|

12.4% (Mar)

|

12.7% (Feb.)

|

|

Total of hens in National flock, 1st cycle (estimate)

|

275.2 million (Feb.)

|

275.2 million (Jan.)

|

*USDA Revised

|

Total U.S. Eggs produced (billion)

|

6.67 FEBRUARY 2025

|

7.59 January 2025

|

|

Total Cage-Free hens in production

Proportion of organic population

|

125.8million (Mar.)

16.2% Organic

|

124.1 million (Feb.)

16.4% Organic

|

|

“Top-5” States hen population (USDA)1

|

134.0 million (Feb.)

|

142.5 million (Jan.)

|

- Revised USDA/EIC Note 1. Texas excluded to maintain confidentiality

PROPORTION OF U.S. TOTAL HENS BY STATE, 2024

Based on a nominal denominator of 280 million hens in flocks over 30,000 covering 95 percent of the U.S complement.

USDA has amended inclusion of specific states in regions and eliminated Texas data to protect confidentiality of Company flock

Sizes

|

STATE

|

FEBRUARY1

2025

|

JANUARY

2025

|

|

Iowa

|

14.7%

|

14.0%

|

|

Indiana

|

12.5%

|

13.1%

|

|

Ohio

|

12.6%

|

14.1%

|

|

Pennsylvania

|

8.0%

|

8.1%

|

|

Texas (estimate)

|

7.5% ?

|

7.2%?

|

|

California

|

1.1%

|

1.0%

|

- Values rounded to 0.1%

Rate of Lay, weighted hen-week (USDA) 82.0% FEBRUARY 2025. 82.6% MARCH 2025

*Revised USDA

|

Revised per capita

|

Egg consumption 2020

|

285.6 (down 7.8 eggs from 2019)

|

|

Revised per capita

|

Egg consumption 2021

|

282.5 (down 3.1 eggs from 2020)

|

|

Actual per capita

|

Egg consumption 2022

|

280.5 (down 2.0 eggs from 2021 due to HPAI)

|

|

Actual per capita

|

Egg consumption 2023

|

278.0 (down 2.5 eggs from 2022)

|

|

Projected per capita

Forecast per capita

|

Egg consumption 2024

Egg consumption 2025

|

270.8 (down 5.2 eggs from 2023) attributed to HPAI losses)*

266.6 (down 6.2 eggs from 2024) forecast regarded as aspirational, was 270.9 last month

|

*Revised, using data from USDA Livestock, Dairy and Poultry Outlook March 17th 2025 taking into account demand from the food service sector and presumably including the effect of HPAI depopulation.

EGG INVENTORIES AT BEGINNING OF MARCH 2025:

|

Shell Eggs

|

1.53 million cases up 6.7 percent from February 2025

|

|

Frozen Egg

Products

|

371,861 case equivalents, down 15.6 percent from February 2025

|

|

Dried Egg

Products

|

Not disclosed since March 2020 following market disruption due

To COVID. Moderate levels of inventory are assumed.

|

EGGS BROKEN UNDER FSIS INSPECTION (MILLION CASES) FEBRUARY 2025 5.99 JANUARY 2025, 6.18*

|

Cumulative eggs broken under FSIS inspection 2024 (million cases)

|

77.2

|

JAN. TO DEC.

|

|

Cumulative 2024: number of cases produced (million)

|

257.9

|

JAN. TO DEC.

|

|

Cumulative 2024: proportion of total eggs broken

|

29.9%

|

(30.8% 2022)

|

|

|

|

|

|

Cumulative eggs broken under FSIS inspection 2025 (million cases)

|

12.2

|

JAN.-FEB.

|

|

Cumulative 2025: number of cases produced (million)

|

39.6

|

JAN.-FEB.

|

|

Cumulative 2025: proportion of total eggs broken

|

30.7%

|

JAN.-FEB

|

EXPORTS FEBRUARY 2025: (Expressed as shell-equivalent cases of 360 eggs).

|

Parameter

|

Quantity Exported

|

|

Exports:

|

2025

|

|

Shell Eggs (thousand cases)

|

JAN. 239 FEB. 259

|

|

Products (thousand case equivalents)

|

JAN. 130 FEB. 166

|

|

TOTAL (thousand case equivalents)*

|

JAN. 369 FEB. 425

|

*Representing 2.1 percent of National production in FEBRUARY 2025 (1.3% shell, 0.7% products).

COSTS AND UNIT REVENUE VALUES1 FOR CONVENTIONAL EGGS FROM CAGED HENS

|

Parameter

|

MARCH 2025

|

FEBRUARY 2025

|

|

4-Region Cost of Production ex farm (1st Cycle)

|

74.7 c/doz

|

76.1 c/doz

|

|

Low

|

72.4c/doz (MW)

|

73.7 c/doz (MW)

|

|

High

|

76.5 c/doz (NE)

|

77.9 c/doz (NE)

|

Notes: 1. Excludes SW and West

Components of Production cost per dozen:-

|

|

MARCH 2025

|

FEBRUARY 2025

|

|

Feed

|

34.9 c/doz

|

36.2c/doz

|

|

Pullet depreciation

|

11.8 c/doz

|

12.0c/doz

|

|

Labor (estimate) plus

|

|

|

|

Housing (estimate) plus

|

28.0c/doz

|

27.9c/doz

|

|

Miscellaneous and other (adjusted May 2023)

|

|

|

Ex Farm Margin (rounded to nearest cent) according to USDA values reflecting MARCH 2025:-

474.0 cents per dozen1- 74.7 cents per dozen = 399.3 cents per dozen (February 2025 comparison: 740.0 cents per dozen – 76.1 cents per dozen = 663.9 cents per dozen.

Note 1: USDA Blended nest-run egg price

|

|

|

MARCH 2025

|

FEBRUARY 2025

|

|

USDA

|

Ex-farm Price (Large, White)

|

474.0 c/doz (Mar.)

|

740.0c/doz (Feb.)

|

|

|

Warehouse/Dist. Center

|

513.0 c/doz (Mar.)

|

820.0c/doz (Feb.)

|

|

|

Store delivered (estimate)

|

519.0 c/doz (Mar.)

|

826.0 c/doz (Feb.)

|

|

|

Dept. Commerce Retail1 National

|

590.0 c/doz (Feb.)

|

495.0 c/doz (Jan.)

|

|

|

Dept. Commerce Retail1 Midwest

|

589.0 c/doz (Feb.)

|

482.0 c/doz (Jan.)

|

1. Unrealistic USDA prices based on promotional prices with few participating stores, non-representative of shelf prices!

|

|

MARCH 2025

|

FEBRUARY 2025

|

|

U.S. Av Feed Cost per ton

|

$225.13

|

$232.93

|

|

Low Cost – Midwest

|

$203.70

|

$210.83

|

|

High Cost – West

|

$260.96

|

$268.70

|

|

Differential

|

$ 57.26

|

$ 57.87

|

|

Pullet Cost 19 Weeks

|

$4.60 MARCH 2025

|

$4.66 FEBRUARY 2025

|

|

Pullet Cost 16 Weeks

|

$4.05 MARCH 2025

|

$4.10 FEBRUARY 2025

|

COSTS AND UNIT REVENUE FOR EGGS FROM CAGE-FREE HENS

|

Parameter

|

MARCH 2025

|

FEBRUARY 2025

|

|

5-Region Cost of Production ex farm (1st Cycle)

|

93.7 c/doz

|

95.3 c/doz

|

|

Low

|

89.4c/doz (MW)

|

90.9 c/doz (MW)

|

|

High

|

100.9 c/doz (West)

|

102.5 c/doz (West)

|

Components of Production cost for cage-free eggs, per dozen:-

|

|

MARCH 2025

|

FEBRUARY 2025

|

|

Feed

|

40.3 c/doz

|

41.7 c/doz

|

|

Pullet depreciation

|

15.6 c/doz

|

15.8 c/doz

|

|

Labor (estimate) plus

|

|

|

|

Housing (estimate) plus

|

37.8c/doz

|

37.8 c/doz

|

|

Miscellaneous and other

|

|

|

Ex Farm Margin (rounded to nearest cent) according to USDA values reflecting negotiated price for MARCH 2025:-

Cage-Free brown 537.0 cents per dozen1- 93.7 cents per dozen = 443.3 cents per dozen

February 2025:- 916.0 cents per dozen - 95.3 cents per dozen = 820.7 cents per dozen

|

|

|

MARCH 2025

|

FEBRUARY 2025

|

|

USDA

|

USDA Average Ex-farm Price1

|

170 c/doz (Jan.)

|

170 c/doz (Dec.)

|

|

|

Warehouse/Dist. Center2

|

537 c/doz (Mar.)

|

916 c/doz (Feb.)

|

|

|

Store delivered (estimate)

|

542 c/doz (Mar.)

|

922 c/doz (Feb.)

|

|

|

Dept. Com. Retail3 C-F Brown

Dept. Com. Retail3 C-F White

|

499 c/doz (Mar.)

Not disclosed (Mar.)

|

799 c/doz (Feb.)

Not disclosed (Feb.)

|

|

|

Dept. Com. Retail3 Organic

Dept. Com. Retail3 Pasture

|

627 c/doz (Mar.)

662 c/doz (Mar.)

|

537 c/doz (Feb)

675 c/doz (Feb.)

|

1. Contract price, nest-run loose. Range 135 to 235 c/doz. unchanged since July and totally unrealistic.

- Negotiated price, loose. Range $6.00 to $8.98 per dozen

- Unrealistic USDA values based on promotional prices with few participating stores non-representative of shelf prices!

(Insert Fig 12 Quarterly CF and organic)

|

Cage-Free* Pullet Cost 19 Weeks

|

$5.58 MARCH 2025

|

$5.64 FEBRUARY 2025

|

|

Cage-Free* Pullet Cost 16 Weeks

|

$4.87 MARCH 2025

|

$4.93 FEBRUARY 2025

|

* Conventional (non-organic) feed

Feed prices used are the average national and regional values for caged flocks. Excludes organic feeds with prices substantially higher than conventional.