USDA Weekly Egg Price and Inventory Report, January 26th 2023.

Market Overview

- The average wholesale unit revenue values for Midwest Extra-large and Large sizes were lower this week by 15.2 percent on average, continuing the downward move for the fourth consecutive week. Mediums were down 10.1 percent indicating an imbalance between supply and demand in this size with pullets commencing production. This past week shell egg inventory was up 2.5 percent despite lower prices. Both retail price and demand will continue to erode as in previous years and as flock numbers are restored prices will moderate. For early 2023 retail purchases will be supported by consumer perceptions of value in an inflationary environment with concern over the high cost for other protein foods. Availability and hence prices are influenced by depletion of close to 44 million hens in 22 large complexes in eleven states extending from the last week in February through mid-December 2022 with the producing flock down 20 million hens compared with pre-HPAI.

- Total industry inventory was higher by 2.3 percent overall this past week to 1.62 million cases with a concurrent 1.6 percent decrease in breaking stock attributed to higher food service and industrial demand. Wholesale unit prices during 2022 into 2023 contrasted favorably with 2020 and 2021 characterized by low ex-plant unit revenue.

- It is now apparent that the inventory held by chains and other significant distributors may be more important over the short term to establishing wholesale price than the USDA regional inventory figures published weekly.

- Due to the depletion of flocks as a result of HPAI, unseasonal high unit revenue will now be a reality into the first quarter of 2023. Sporadic outbreaks of HPAI are likely given the Southward migration of waterfowl. The number and extent of outbreaks cannot be assessed until more information is available concerning the molecular and field epidemiology relating to cases. The USDA has yet to identify modes of transmission including airborne spread and possible deficiencies in biosecurity on affected complexes that presumably demonstrated specific risk factors. APHIS has been negligent in evaluating available data and providing timely practical guidance on prevention.

- The current relationship between producers and chain buyers based on a single price discovery system constitutes an impediment to a free market. The benchmark price amplifies both downward and upward swings as evidenced over the past three months. The benchmark functions to the detriment of the industry over the long term. A CME quotation based on Midwest Large, reflecting demand relative to supply would be more equitable. If feed cost is determined by CME ingredient prices then generic shell eggs should be subject to a Midwest Large quotation.

- According to the USDA the U.S. flock in production was down by a net 0.4 million or 0.1 percent to 302.1 million hens during the week ending January 25th. The flock in production includes about 3.0 million molted hens that resumed lay during the past week plus 4.0 million pullets attaining production.

- The ex-farm price for breaking stock was down 5.8 percent this past week to 228 cents per dozen. Checks delivered to Midwest plants were down 3.8 percent to 222 cents per dozen. Prices for breaking stock will remain high over the period of recovery from HPAI as replacement flocks mature but the price levels will be more extreme than during the 2015-2016 epornitic.

|

The Week in Review

Prices

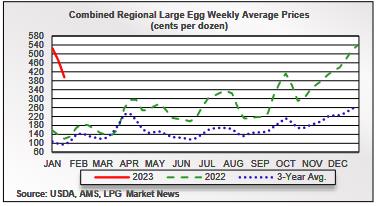

According to the USDA Egg Market News Reports released on January 23rd the Midwest wholesale price (rounded to one cent) for Extra-large was down 15.2 percent to $3.30 per dozen. Large size was down 15.1 percent to $3.28 per dozen; the Medium price was down 10.1 percent to $2.49 per dozen as delivered to DCs. Prices should be compared to the USDA benchmark average 6-Region blended nest-run cost of 80.1 cents per dozen in December, excluding provisions for packing, packaging materials and transport, amounting to 50 cents per dozen according to the EIC. The progression of prices during 2022 to date is depicted in the USDA chart reflecting three years of data, updated weekly.

The January 23rd 2022 edition of the USDA Egg Market News Report documented a USDA Combined Region value rounded to the nearest cent, of $3.95 per dozen delivered to warehouses for the week ending January 17th 2023. This average price lags current Midwest weekly values by one week. The USDA Combined range for Large in the Midwest was $3.86 per dozen. At the high end of the range, the price in the South Central region attained $4.05 per dozen. The USDA Combined Price last week was approximately $3.00 above the 3-year average. This past week Midwest Large was approximately $2.80 above the corresponding week in 2022. Prices in 2022 were considerably higher over the comparable 2021 period extending from Thanksgiving through post-Christmas compared to 2021.

Flock Size

The USDA adjusted the estimate of flock size to reflect depopulation of more than 31.1 million hens through June 6th as a result of the spring wave of HPAI with subsequent depopulation of approximately 13 million additional hens in Ohio, Colorado, Iowa, Oregon and South Dakota by mid-December. According to the USDA the number of producing hens reflecting January 25th (rounded to 0.1 million) was down 0.4 million or 0.1 percent to 302.1 million. The total U.S. flock includes about 3.0 million molted hens due to come back into production with approximately 4.0 million new pullets reaching maturity each week based on USDA chick hatch data. The increase is offset by routine flock depletion in addition to losses over past months due to the HPAI epornitic. Based on inventory level and prices the hen population producing eggs should now be in mild oversupply relative to consumer demand. Industrial and food service off-take although increasing, has not reverted to pre-COVID levels. Prices will continue to fluctuate, trending downward through early 2023. Prices of shell eggs and products will also depend on any future incident outbreaks of HPAI offset by the contribution of new pullets and of molted hens to supply.

According to the USDA the total U.S. egg-flock on January 25th was down 0.4 million to 304.6 million hens including second-cycle birds and those in molt. The nominal difference of 2.5 million (2.5 million last week) between hens in production and total hens is an approximate figure but denotes that many molted hens resumed production to meet pre-Easter demand. At present there are now at least 20 million fewer hens in both the total and producing flocks with the difference equivalent to about six percent of the pre-HPAI national flock of 325 million hens.

INVENTORY LEVELS

Cold storage stocks of frozen products in selected regions on January 23rd 2022 amounted to 2.378 million pounds (1,081 metric tons) of frozen egg products, up 1.4 percent from the inventory of 2.346 million lbs. on January 1st 2023. The monthly USDA Cold Storage Report below quantifies a reduction in the actual total stock level.

The most recent monthly USDA Cold Storage Report released on January 25th 2023 documented a total stock of 24.2 million pounds (11,020 metric tons) of frozen egg products on December 31st 2022. This quantity was down 2.0 percent from the December 31st 2021 value of 24.7 million pounds. December 31st frozen egg inventory was up 1.9 percent from November 30th 2022 despite depletion of 41 million hens at this time. Compared to December 31st 2021 yolks were up 5.2 percent to 911 million lbs.

A total of 82.2 percent of combined inventory (19.9 million lbs.) comprised the categories of “Whole and Mixed” (42.5 percent) and “Unclassified” (39.7 percent). The lack of specificity in classification requires a more diligent approach to enumerating and reporting inventory by the USDA

Shell Inventory

The USDA reported that the national stock of generic shell eggs effective January 23rd 2023 was up 2.5 percent compared to the previous week. The relative movement of stock over the previous week suggests declining consumer demand consistent with the price trajectory. Combined with breaking stock, the total inventory of shell eggs in the industry is now at 1.62 million cases (1.58 million last week and 35,800 cases lower). The U.S. population of laying hens at this time is influenced by the number of hens culled due to HPAI, and includes the population unaffected by HPAI, flocks retained after molting (with an anticipated increase in this category depending on available housing capacity) and started pullets from chick placements in late-July 2022. Going forward, older hens will assume a larger proportion of the national flock as more flocks are molted especially as many “at risk” pullet flocks were depleted due to HPAI.

Five of six USDA Regions reported higher stock levels this past week. The regions are listed in descending order of stock: -

- The Midwest Region was up 6.1 percent compared to the previous week to 427,100 cases.

- The South Central Region was up 0.7 percent to 257,000 cases

- The Southeast Region was down 3.8 percent to 241,100 cases

- The Northeast Region was up 2.6 percent to 191,400 cases.

- The Southwest Region was up 4.6 percent to 121,800 cases

- The Northwest Region was up 8.9 percent to 53,000 cases

The total USDA six-area stock of commodity eggs comprised 1,617,100 cases, up 2.3 percent, of which 79.9 percent were shell eggs (79.7 percent last week denoting continued and unseasonal post-holiday demand). The inventory of breaking stock was up 1.4 percent percent to 325,700 cases. Shell egg inventory was up 2.5 percent attaining 1,291,400 cases. The relatively lower level of breaking stock over the past week is attributed to a combination of diversion to the shell egg market and higher demand for liquids by industry, food service and consumers relative to supply. The average price for Midwest checks and breaking stock combined was 68.4 percent of the average value of Midwest Extra-large and Large shell eggs (last week 56.9 percent) confirming the diversion of uncommitted eggs and some in-line breaking stock to the shell market. The differential can be compared to 80.0 percent in April 2020 reflecting the initial period of high demand for both shell eggs and breaking stock after the onset of HPAI. This past week the wholesale Midwest Extra- large and Large shell egg prices were lower by an average of 15.2 percent compared to breaking stock and checks combined that were down 4.8 percent on average from the previous week. This demonstrates the interconnectivity of the packing and breaking segments of the egg industry under circumstances of extreme disturbance in either supply (HPAI) or demand (COVID). The price for breaking stock and for checks is influenced by the relative demand for generic shell eggs and contract obligations with breakers.

On January 23rd 2022 the inventory of other than generic eggs amounting to 345,400 cases (up 2.1 percent from last week at 337,900 cases) among three categories (with the previous week in parentheses) comprised:-

- Specialty category, up 3.3 percent to 35,800 cases. (Was down 3.3% to 34,600 cases)

- Certified Organic, down 3.3 percent to 68,400 cases. (Was up 5.2 percent to 70,700 cases)

- Cage-Free category, up 3.7 percent to 241,200 cases. (Was down 0.8% to 232,600 cases)

Demand for cage-free product will not increase materially while generic eggs from caged flocks and surplus down-classified cage-free eggs are on the shelf at $2.00 to $2.40 per dozen during normal supply conditions over the long term. Existing and proposed individual state legislation mandating sale of only cage-free eggs will support most of the anticipated transition from cages but total re-housing will not be completed, and ultimately never, by the beginning of 2025, less than 24 months away. The constitutional status of Proposition #12 was considered in oral arguments presented to SCOTUS on October 11th with specific reference to the Dormant Commerce Clause relating to interstate trade. Many chains are reneging on or extending their commitments to achieve an acceptable transition to cage-free eggs. With the current proportion of non-caged flocks, cage-free eggs are surplus to demand in some areas and are becoming a commodity in many markets subjected to the same price pressures as generic eggs from caged hens. Growth in demand for organic product has been static for months.

Long-term demand for cage-free eggs is influenced by the relative shelf prices of the category in comparison with generic white-shelled eggs from caged flocks. At the other end of the price range, consumers will purchase less-expensive brown cage-free product over organic eggs when there is a differential in price greater than about $1.20 per dozen under normal balance between supply and demand. Similarly, consumers will traditionally purchase white-shelled generic eggs in preference to brown-shelled cage-free with a differential of over $1.20 per dozen.

The need for comprehensive structured statistically relevant market research on the willingness to pay for attributes such as housing, shell color, GM status and nutritional enrichment is self-evident. As in 2015, the ongoing 2022 HPAI epornitic will provide a valuable opportunity for economists to determine the price elasticity for eggs provided funding is made available to agricultural economists at Land Grant Universities.

RELATIVE PRICES OF SHELL-EGG CATEGORIES

USDA-AMS posted the following national shell egg prices as available, for January 20th 2023 in the Egg Markets Overview report for dozen cartons with comparable prices in parentheses for the previous week: -

Large, in cartons generic white: Not released ($2.99)

Large, in cartons cage-free brown: Not released. (Not released)

Large, California in Cartons: $5.97 down 11.2 percent ($6.72)

Wholesale

National loose, (FOB dock): $2.31 down 0.5 percent ($2.32)

NYC in cartons to retailer: $3.36 down 13.4 percent ($3.88)

Midwest in cartons to warehouse: $3.87 down 16.2 percent ($4.62)

The following advertised retail prices for the week ending January 26th 2023, (compared with the previous week in parentheses) were posted by the AMS on January 25th for dozen packs:

| USDA Certified Organic, Brown, Large: |

$4.991 |

($3.77) |

| Cage-Free Brown, Large: |

none |

($4.70) |

| Omega-3 Enriched Specialty, White, Large: |

$3.841 |

($3.77) |

| Generic White, Large Grade A |

$4.03 |

($2.92) |

| Generic White, Large Grade A (Feature price) |

$2.92 |

($2.92) |

1 Based on a small sample with few advertised promotions

The USDA posted a featured benchmark price for generic white eggs of $4.03 per dozen up $1.04 or 35.6 percent from last week. USDA Certified organic brown was up $1.22 per dozen or 32.4 percent to $4.99 per dozen. Large week-to-week fluctuations can be expected in the stock of specialty and organic eggs based on the small base of these categories.

The limited number of low advertised prices for generic white recorded in recent weeks represented loss leaders by chains to attract consumers concerned over food inflation. Fluctuation in shelf prices will have little impact on demand for generic categories given restricted availability, increasing demand and concurrent higher advertised shelf prices for specialty and cage-free brown eggs. Current supply was probably above demand this past week with independent producers continuing to divert more shell eggs from breaking. Retail demand will continue to be supported by home cooking and baking and reinforced by seasonal dining out as COVID is now almost ignored. Eggs and product purchases will be limited among some demographics by their disposable incomes and inflation.

Features for the major categories this week included Organic (57.4 percent with no features last week); Cage-free (not featured compared to 51.4 percent) despite relatively high stock in this category) and Omega-3 enriched, (22.3 percent, up from 14.9 percent). The remaining 20.3 percent was divided among Large at 3.6 percent and Mediums at 16.7 percent this past week. This confirms that retailers promote generic categories only if available in excess of demand or under current circumstances, as loss leaders in a high-priced market.

USDA Quarterly Shell-egg Use by Segment July-September:

Retail 54.8%; Breaking 30.9%; Institutional 12.9%; Exports 1.4%.

USDA Cage-Free Data

According to the latest monthly USDA Cage-free Hen Report released on January 3rd 2022, the number of certified organic hens during December 2022 was unchanged from November 2022 at 18.0 million. This is 0.6 percent lower than the average of 18.1 million during Q2 of 2022.

The USDA reported the cage-free (non-organic) flock to be 0.9 percent lower at 88.0 million in December 2022.

According to the USDA the population of hens producing cage-free and certified organic eggs in December 2022 comprised: -

Total U.S. flock held for USDA Certified Organic production = 18.0 million (18.0 million in Q3 2022).

Total U.S. flock held for cage-free production = 88.0 million (87.0 million in Q3 2022).

Total U.S. non-caged flock =106.0 million (105.0 million in Q3 2022).

This total value represents 33.0 percent (last month 32.4 percent) of a nominal 324 million total U.S. flock (but 35.0 percent of the national flock after HPAI mortality to 305 million). Hens certified under the USDA Organic program have decreased in proportion to cage-free flocks since Q1 of 2021.

The accuracy of individual monthly values is questioned given a history of either sharp changes or no change in successive months as documented over the past two years. Precise quarterly reports would be more suitable for the industry in planning expansion and allocation of capital.

Processed Eggs

For the processing week ending January 21st 2022 the quantity of eggs processed under FSIS inspection during the week as reported on January 25th 2022 was down 2.4 percent compared to the previous processing week to a level of 1,421,389 cases, (1,456,404 cases last week). The proportion of eggs broken by in-line complexes was 50.2 percent (48.6 percent in-line for the previous week) indicating greater use of contract and purchased eggs. The differential in price for shell sales and breaking will determine the movement of uncommitted eggs. This past week 70.2 percent of egg production was directed to the shell market, (69.6 percent for the previous week) responding to relatively higher prices paid by packers. Breaking stock inventory was up 1.4 percent this past week to 325,700 cases despite diversion to shell-egg markets. Increased demand from QSRs and casual dining, complemented by increased demand from baking and eat-at-home is maintaining volume. During the corresponding processing week in 2020 (during-COVID) in-line breakers processed 54.9 percent of eggs broken.

For the most recent monthly report for week ending January 7th 2022, yield from 5,371,057 cases (6,908,740 cases last month) denoted a decrease in demand for liquid over the period December 4th through December 31st 2022. Edible yield was 41.7 percent, distributed in the following proportions expressed as percentages: - liquid whole, 61.4; white, 23.7; yolk, 11.9; dried, 3.0.

All eggs broken during 2022 attained 76.22 million cases, 2.0 percent less than 2021. Eggs broken in 2023 to date amounted to 4,217,583 cases, 11.4 percent less than the corresponding period in 2022. This is attributed to decreased demand for egg liquids from retail, food service and QSRs and casual dining restaurants despite restoration of service as COVID restrictions are successively relaxed.

PRODUCTION AND PRICES

Breaking Stock

The average price for breaking stock was down 5.8 percent this past week at an average of 228 cents per dozen with a range of 215 to 240 cents per dozen delivered to Central States plants on January 23rd. Checks were down 3.8 percent this past week to an average of 222 cents per dozen over a narrow range of 231 to 223 cents per dozen.

Shell Eggs

The USDA Egg Market News Report dated January 23rd 2022 confirmed that Midwest wholesale prices for Extra-large and Large sizes were down by 15.2 percent compared to the previous week. Mediums were down 15.1 percent. Prices have fallen for four weeks after ten consecutive weekly increases with mostly downward fluctuation in weekly inventory. This suggests progressively lower prices until the pre-Easter surge. The following table lists the “most frequent” ranges of values as delivered to warehouses*: -

|

Size/Type

|

Current Week

|

Previous Week

|

|

Extra Large

|

328-331 cents per dozen

|

386-389 down 15.2%

|

|

Large

|

326-329 cents per dozen

|

384-387 down 15.1%

|

|

Medium

|

247-250 cents per dozen

|

275-278 down 10.1%

|

|

Processing:-

|

|

|

|

Breaking stock

|

215-240 cents per dozen

|

240-243 down 5.8%

|

|

Checks

|

221-223 cents per dozen

|

230-232 down 3.8%

|

*Store Delivery approximately 5 cents per dozen more than warehouse price

The January 23rd 2023 Midwest Regional (IA, WI, MN.) average FOB producer price, for nest-run, grade-quality white shelled Large size eggs, with prices in rounded cents per dozen were down 48.9 percent from last week, (with the previous week in parentheses): -

- $2.20 ($3.48), (estimated by proportion): L. $3.05 ($5.97): M. $2.26 ($4.11)

The January 23rd 2023 California price per dozen for cage-free, certified Proposition #12 compliant Large size in cartons delivered to a DC, (with the previous week in parentheses) was down 5.8 percent for the week.

- $5.82 ($6.17); L. $5.62 ($5.97); M. $3.96 ($4.11)

(See the text, tables and figures and the review of production data and prices comprising the USDA Report for November and the 2nd Quarter FY 2023 results for Cal-Maine Foods under the Statistics Tab)

Shell-Egg Demand Indicator

The USDA-AMS Shell Egg Demand Indicator for January 25th was down 2.1 points from the last weekly report to zero with a 2.5 percent total increase in shell inventory from the past week as determined by the USDA-ERS as follows: -

|

Productive flock

|

302,142,750 million hens

|

|

Average hen week production

|

81.5% (was 81.5%)

|

|

Average egg production

|

246,111,553 per day

|

|

Proportion to shell egg market

|

70.2% (was 69.6%)

|

|

Total for in-shell consumption

|

480,588 cases per day

|

|

USDA Inventory

|

1,260,000 cases

|

|

26-week rolling average inventory

|

4.27 days

|

|

Actual inventory on hand

|

4.27 days

|

|

Shell Egg Demand Indicator

|

zero points (was 2.1 on January 18th 2023)

|

Note 1: USDA Flock numbers were adjusted after incident cases of HPAI in mid-May. The latest estimate of hen population takes into account the depletion of approximately 44 million hens in 22 large complexes (holding over 500,000 hens) in addition to smaller units in all in eleven states followed by successive weekly pullet placements progressively restoring the national flock.

Dried Egg Products

The USDA extreme range in prices for dried albumen and yolk products in $ per pound was released on January 20th 2023. Data posted by the USDA is incomplete but available values are depicted for the previous week and past months to illustrate the trend in prices influenced by HPAI depopulation:-

|

Whole Egg

|

$11.25 to $13.25

|

Average Sept. $10.94

Oct. $12.69

Nov. Dec. $12.50

|

|

Yolk

|

$12.00 to $14.30

|

Average Sept. $14.31

Oct. $15.33

Nov. $14.65

|

|

Spray-dried white

|

No quotation, past week

|

Average Sept. $12.53

Oct. no release

Nov. no release

Dec. $14.18

|

|

Blends

|

No quotation, past week

|

|

Frozen Egg Products

The USDA range in prices for frozen egg products in cents per lb. on January 20th 2023 compared to the previous week were on average lower but indicating a balance between available products and demand from the manufacturing and retail sectors: -

|

Whole Egg

|

$2.20 - $2.45

|

$2.45 - $2.80

|

|

White

|

$1.80 - $2.10

|

$2.00 - $2.30

|

|

Average for Yolks

|

$3.62 - $3.72

|

$3.55 - $3.65

|

The December averages for non-certified truckload quantities are tabulated (cents per lb.): -

Whole, 236c; Whites, 182c; Yolks, 350c.

The USDA has not released a report on dried egg inventory since March 13th 2020 due to inability to obtain data from producers, and will not issue reports for the immediate future.

COMMENTS

Prevalence rates from APHIS surveys of migratory waterfowl in the Atlantic and Mississippi Flyways confirmed that birds were shedding H5 avian influenza virus expressing an Eurasian lineage from late January 2022 onwards. This is confirmed by subsequent outbreaks in backyard flocks and combinations of commercial egg complexes, broiler and turkey growing farms among the four flyways. It is evident that some wild domestic birds are shedding virus based on cases in backyard flocks. This situation requires more intensive monitoring including wild endemic birds and small mammals with guidance by USDA-APHIS to maintain high levels of biosecurity.

Outbreaks in commercial egg-producing flocks extended from February 23rd to December 18th

To date approximate losses in commercial flocks with confirmed HPAI and updates include:-

- 2,600,000 broilers on 14 farms in 7 states

- 330,000 broiler breeders on 11 farms in 6 states

- 9,600,000 turkeys including a few breeder flocks on 218 farms in 7 states

- 4400,000 egg-production hens in total with 95 percent on 22 large complexes above 0.5 million in addition to 1,050,000 pullets with a total of 40 locations in 11 states. Pullet mortality does not include “at risk” replacements depleted on affected complexes with contiguous pullet rearing.

For 2022 to mid- December, 301 commercial flocks were infected in addition to 397 diagnosed backyard flocks with total losses of approximately 55 million birds of all species.

From April through November, Canada recorded 143 outbreaks in commercial flocks in nine Provinces and has depopulated 3.6 million commercial poultry including hens, turkeys and broilers. In addition numerous confirmations of HPAI were made in backyard and subsistence flocks. Isolation of H5N1 avian influenza is a function of surveillance intensity.

Unlike in previous years there are continuing reports from the E.U. documenting shedding of H5N1 by migratory waterfowl with mortality in other than anseriform wild birds in addition to foxes and marine mammals. Outbreaks of HPAI are still occurring on commercial farms in Eastern and Western Europe. Incident cases have been confirmed in Japan and South Korea during the past two months. These outbreaks were attributed to contact with migratory birds. Domestic chicken, turkey and duck flocks will be vulnerable, if as usual they are allowed access to pasture. Most veterinary authorities in Western Europe and some in the U.S. have advised flock confinement with obligatory housing in the U.K. and France due to increasing rates of recovery of H5N1 HPAI from migratory waterfowl. Avian influenza strains H5 and H7 persist in Western and Eastern Europe, Asia and both Western and Southern Africa. France and Holland are evaluating DNA vaccines. Mexico has introduced vaccination. An International conference on vaccination against HPAI took place in Paris on October 25th and 26th and considered trade barriers to implementation of vaccination.

Backyard flocks that are allowed outside access will continue to be at risk of infection in the U.S. These small clusters of birds in suburban areas are of minimal significance to the epidemiology of avian influenza as it affects the commercial industry. Backyard flocks serve as indicators of the presence of virus among free-living birds as evidenced by ongoing outbreaks in commercial poultry flocks across the U.S.

The level of biosecurity in commercial egg production complexes and broiler farms is appreciably higher than in 2015 when the U.S. experienced an epornitic along the Mississippi Flyway The response of state and federal authorities since this time has been rapid and effective both in diagnosing and depleting affected flocks. To date, all floor-housed flocks that were infected were depleted using foam. Euthanasia of egg production complexes involved various combinations of VSD+ applying heat or carbon dioxide or conventional kill-carts flushed with carbon dioxide.

The role of migratory waterfowl in introduction and subsequent dissemination of H5N1 HPAI virus is indicated by the close proximity of infected complexes and their counties with major waterways, lakes, wetlands or reservoirs during the spring and fall months of 2022. There is now limited subjective evidence of aerogenous transmission of HPAI over short distances with virus (possibly shed by wild endemic and migratory birds) becoming entrained in dust and introduced into ventilation inlets by powered ventilation systems.

It would have been of practical and financial benefit for APHIS epidemiologists to have reported on their findings from the epidemiologic questionnaires completed following outbreaks on commercial farms and with special reference to the first seven large complexes affected through the end of March. The industry should have been advised of identified routes of infection and whether any obvious defects in structural or operational biosecurity contributed to outbreaks. This would have facilitated appropriate preventive action and allocation of additional resources to intensified biosecurity.

A preliminary opinion with guidance during mid-April 2022 concentrating on 12 large egg complexes was not an unrealistic request and an interim report by early-June would have provided more value than a comprehensive document scheduled for mid-2023 or later. This is especially the case since large egg complexes in Northwest Ohio and in Colorado were infected during September, in Iowa in October and November and in Oregon and South Dakota during early December 2022. This suggests ongoing exposure from wild domestic birds and possibly mammals in addition to migratory waterfowl as evidenced by the increasing incidence in backyard flocks that effectively serve as sentinels.