USDA-WASDE FORECAST #610 MARCH 9th 2021

OVERVIEW

The March 9th 2021 USDA WASDE Report was basically unchanged from the February 2021 edition to reflect the 2021 season. This normal given uncertainties regarding the future crop that has yet to be planted. The USDA ERS will make changes to projected ending stocks in April and May depending on export trends and harvests in Brazil and in the Southern hemisphere. There was no change in either U.S. corn or soybean harvest areas from the February WASDE report but this may be altered subsequently by world prices and weather considerations. The corn acreage to be harvested is currently estimated at 82.5 million acres and soybeans will be harvested from 82.3 million acres.

The March 2021 WASDE estimate of corn yield was held at172.0 bushels per acre, (175.8 bushels per acre in 2020). The estimate of soybean yield was maintained at 50.2 bushels per acre. (50.7 bushels per acre in 2020)

The March 2021 USDA projection for the ending stock of corn was unchanged at 1,502 million bushels. Despite ongoing exports the ending stock for soybeans was held at 120 million bushels but may subsequently be downsized.

Projections for ending stocks of both corn and soybeans have influenced recent CME price quotations concurrently with increased exports in accordance with the needs of China less than compliance with the Phase-One trade agreement. The March 2021 WASDE projected the corn price to be $4.30 per bushel and soybeans at 1,115 cents per bushel.

It is accepted that projections are based on the assumption that China has sharply increased purchases partly to cover disruptions during the first quarter of 2020 by COVID-19. China booked substantial orders for corn and soybeans to be delivered through August for the 2019-2020 market year in addition to large quantities booked from September onwards for the 2020-2021 market year. Reports on volumes of commodities exports to China will be included in upcoming weekly editions of CHICK-NEWS and EGG-NEWS in subsequent mailings as data becomes available.

CORN

The corn harvest for 2021 projected in the March 2021 WASDE Report #610 is unchanged at 14,183 million bushels consistent with planting intentions.The projected 2021 harvest can be compared to 14,507 million bushels in 2020 and is 6.4 percent lower than the previous 2016 record harvest of 15,148 million bushels. The “Feed and Residual” category was held at 5,650 million bushels. The “Ethanol and Byproducts” category was maintained at 4,950 million bushels despite reduced domestic demand for E-10 due to COVID-19 restrictions and competition in the export markets. Corn exports were held at 2,600 million bushels in the face of intense competition from Brazil and Argentine and high world domestic coarse grain production relative to demand. Ending stocks were unchanged at 1,502 million bushels.

The forecast USDA farm price for corn was maintained at 430 cents per bushel. At 15H30 on March 9th after release of the WASDE the CME quotations for March corn was 552 cents per bushel, up 1.1 percent from the quotation on February 9th and currently 30.7 percent above the March USDA projection for 2021.

March 2021 WASDE #610 PROJECTIONS FOR THE 2021 CORN HARVEST:

|

Harvest Area

|

82.5 m acres

|

(90.8 m. acres planted, harvest corresponding to 90.9% of acres harvested)

|

|

Yield

|

172.0 bushels per acre

|

(was 175.8 bushels per acre in December WASDE.)

|

|

Beginning Stocks

|

1,919 m. bushels

|

|

Production

|

14,183 m. bushels

|

|

Imports

|

25 m. bushels

|

|

Total Supply

|

16,127 m. bushels

|

Proportion of Supply

|

|

Feed & Residual

|

5,650 m. bushels

|

35.1%

|

|

Food & Seed

|

1,425 m bushels

|

8.8%

|

|

Ethanol & Byproducts

|

4,950 m. bushels

|

30.7%

|

|

Domestic Use

|

12,025 m. bushels

|

74.6%

|

|

Exports

|

2,600 m. bushels

|

16.1%

|

|

Ending Stocks

|

1,502 m. bushels

|

9.3%

|

|

Ending Stock-to-domestic use proportion

|

12.5%

|

(Was 12.9 % in the January 2021 WASDE Report)

|

1 metric ton = 39.368 bushels

Average Farm Price: $4.30 per bushel. (Up 10 cents from the January 2020 WASDE Report)

SOYBEANS and SOYBEAN MEAL

USDA projected the 2021 soybean crop at 4,135 million bushels. The 2021 harvest is based on a yield of 50.2 bushels per acre. With respect to use parameters, crushings were held at 2,200 million tons. Projected exports were maintained at 2,250 million bushels, based on orders from China during the 2020-2021 market year. This is attributed to requirements and to lock-in prices in a rising market less than complying with the Phase-One Trade Agreement. From early October to the present prices increased in response to bookings for the 2020-2021market year. Prior to 2018 our largest trading partner imported the equivalent of 25 percent of U.S. soybeans harvested. Ending stocks were held at 120 million bushels as predicted in the February 2021 WASDE.

The USDA projection of the ex-farm price for soybeans for the 2020 harvest was retained at 1,115 cents per bushel, unchanged from the February 2020 WASDE estimate. At 15H30 on March 9th and following release of the WASDE, the CME quotations for soybeans for March 2021 delivery was 1,443 cents per bushel, up 2.8 percent compared to February 9th 2021and 29.4 above the March USDA projection for 2021.

March 2021 WASDE #610 PROJECTION FOR THE 2021 SOYBEAN HARVEST:-

|

Harvest Area

|

82.3 m acres

|

(83.1 m. acres planted, harvest corresponding to 99.0% of planted acreage)

|

|

Yield

|

50.2 bushels per acre

|

(Was 50.7 bushels per acre in the December WASDE)

|

|

Beginning Stocks

|

525 m. bushels

|

(Up fractionally from the December 2020 WASDE)

|

|

Production

|

4,135 m. bushels

|

|

Imports

|

35 m. bushels

|

|

Total Supply

|

4,695 m. bushels

|

Proportion of Supply

|

|

Crushings

|

2,200 m. bushels

|

46.8%

|

|

Exports

|

2,250 m. bushels

|

47.9%

|

|

Seed

|

103 m. bushels

|

2.2%

|

|

Residual

|

22 m. bushels

|

0.5%

|

|

Total Use

|

4,575 m. bushels

|

97.4%

|

|

Ending Stocks

|

120 m. bushels

|

2.6%

(Was 140 m. bushels in the January 2021 WASDE)

|

1 metric ton = 76.34 bushels

Average Farm Price: 1,115 cents per bushel (Unchanged from the February 2021 WASDE Report)

The projected supply of soybean meal was unchanged at 52.9 million tons. Domestic use was unchanged at 38.3 million tons. Exports were held at 14.25 million tons. The USDA increased the ex plant price of soybean meal to $400 per ton unchanged from February. At 15H30 on March 9th the CME quotation for March 2021 delivery of soybean meal was $419, down $20 per ton or 4.6 percent less compared to the February 9th quotation and 4.8 percent above the March USDA projection for 2021.

March 2021 WASDE #610 PROJECTION OF SOYABEAN MEAL PRODUCTION AND USE

|

Beginning Stocks

|

0.341 m. tons

|

|

Production

|

51.959 m. tons

|

|

Imports

|

0.600 m. tons

|

|

Total Supply

|

52.900 m. tons

|

|

Domestic Use

|

38.300 m. tons

|

|

Exports

|

14.250 m. tons

|

|

Total Use

|

52.550 m. tons

|

|

Ending Stocks

|

0.350 m. tons

|

- = million

Average Price ex plant:$400 (Unchanged from the February 2021 WASDE Report)

IMPLICATIONS FOR PRODUCTION COST

The price projections based on CME quotations for corn and soybeans suggest low to stable production costs for broilers and eggs. Going forward, prices of commodities will be determined by World supply and demand and U.S. domestic yield, use and exports.

- For each 10 cents per bushel change in corn:-

- The cost of egg production would change by 0.45 cent per dozen

- The cost of broiler production would change by 0.25 cent per live pound

- For each $10 per ton change in the cost of soybean meal:-

- The cost of egg production would change by 0.40 cent per dozen

- The cost of broiler production would change by 0.25 cent per live pound.

WORLD SITUATION

With respect to world coarse grains and oilseeds the March WASDE included the following appraisals:-

Global coarse grain production for 2020/21 is forecast 5.9 million tons higher to 1,444.8 million. The 2020/21 foreign coarse grain outlook is for larger production, increased trade, and greater ending stocks relative to last month. Foreign corn production is forecast higher with increases for India, South Africa, and Bangladesh that are partly offset by a decline for Mexico. India corn production is higher with increases to both area and yield. South Africa corn production is raised reflecting more favorable yield prospects. World barley production is higher with an increase for Australia.

Corn exports are raised for India, Vietnam, and South Africa. Imports are increased for Vietnam, Bangladesh, and the Philippines. Barley exports are raised for Australia, with higher imports for Saudi Arabia and Algeria. Foreign corn ending stocks for 2020/21 are higher, mostly reflecting increases for India, Vietnam, and Paraguay that are partly offset by reductions for Argentina and Mexico. Global corn ending stocks, at 287.7 million tons, are up 1.1 million from last month.

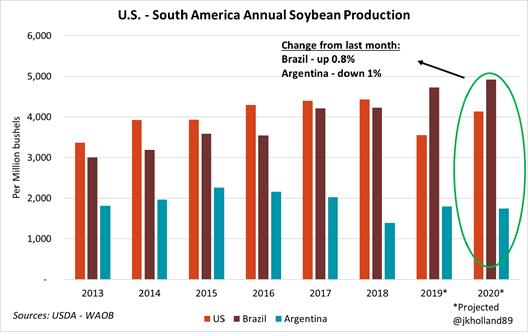

This month’s 2020/21 U.S. soybean outlook is for increased exports and lower ending stocks. Soybean exports are projected at 2.25 billion bushels, up 20 million from last month reflecting record marketing-year exports through January and a slow start to Brazil’s export season resulting from harvest delays. With crush unchanged, soybean ending stocks are reduced 20 million bushels to 120 million. If realized, soybean ending stocks would be down 77 percent from 2019/20, and the lowest since 2013/14.

Global 2020/21 oilseed supply and demand forecasts include higher production, exports, and ending stocks. Global production is raised 0.7 million tons to 595.8 million, with higher soybean and rapeseed partly offset by lower palm kernel, cottonseed, and sunflowerseed. Soybean production for Brazil is raised 1 million tons to 134 million, reflecting a revision to the 2019/20 crop and this season’s expected yield trend. India’s soybean production is raised 0.2 million tons to 10.7 million based on updated government area data. Conversely, Argentina’s soybean production is reduced 0.5 million tons to 47.5 million due to dry weather conditions over the past month.

Global oilseed exports are raised 0.8 million tons to 194.7 million, mainly on higher rapeseed exports for Ukraine and Australia. Rapeseed imports are increased for the EU-27+UK where the crop is also raised to 17.1 million tons based on updated government data. Global soybean crush is forecast up 1.6 million tons to 323.6 million as higher crush for Argentina and Brazil is partly offset by lower crush for China. Higher crush in Argentina results in higher meal and oil exports. Soybean crush for China is lowered 1 million tons to 98 million based on data to date. Global soybean stocks are slightly higher, with increased stocks for China and Brazil that are mostly offset by lower stocks for Argentina.

Updated World production and use of total grains and oilseeds is summarized for the 2020/2021 season taking into account Northern and Southern Hemisphere production:-

|

Factor: billon m. tons

|

Coarse Grains

|

Oil Seeds

|

|

Output

|

1.445*

|

596

|

|

Supply

|

1.777

|

708

|

|

World Trade

|

230

|

195

|

|

Use

|

1.459

|

514

|

|

Ending Stocks

|

318

|

96

|

*Values rounded to million m. tons

(1 metric ton corn= 40 bushels) (“ton” represents 2,000 pounds)