USDA Weekly Egg Price and Inventory Report, June 8th 2023

Market Overview

- The average wholesale unit revenue values for Midwest Extra-large and Large sizes were unchanged this past week but representing a lower than seasonal late spring value. The rise after a plateau last week signified a market bounce, terminating the precipitous decline over the previous six weeks. Mediums were also unchanged, albeit above a sub-breakeven price with a 10-cent per dozen price differential from Large. This suggests restoration in the balance between supply and demand in this size. This past week shell egg inventory was up a noteworthy 7.0 percent, compared to a rise of 2.2 percent last week. This is inconsistent with presumably higher demand as shelf prices for generics fall. The recent rise in inventory is probably due to chains holding back on orders to reduce the benchmark price. Over the coming three weeks the volume of retail purchases will be influenced by seasonal demand. As chains reduce margins consistent with wholesale prices, higher demand can be anticipated. Eggs are now highly competitive in price against the comparable costs for other protein foods despite unrealistic retail margins imposed by some chains.

- Total industry inventory was up by 6.1 percent overall this past week to 1.79 million cases with a concurrent 1.6 percent decrease in breaking stock attributed to diversion to the shell market and presumably higher demand during late spring from food service, manufacturers and increased exports. Volume this past week was not affected by lower prices for egg products. Wholesale shell egg prices compare with 2020 and 2021, also characterized by low ex-plant unit revenue. Benchmark prices were $1.10 per dozen lower than for the corresponding week in 2022, inflated by flock depletions following HPAI.

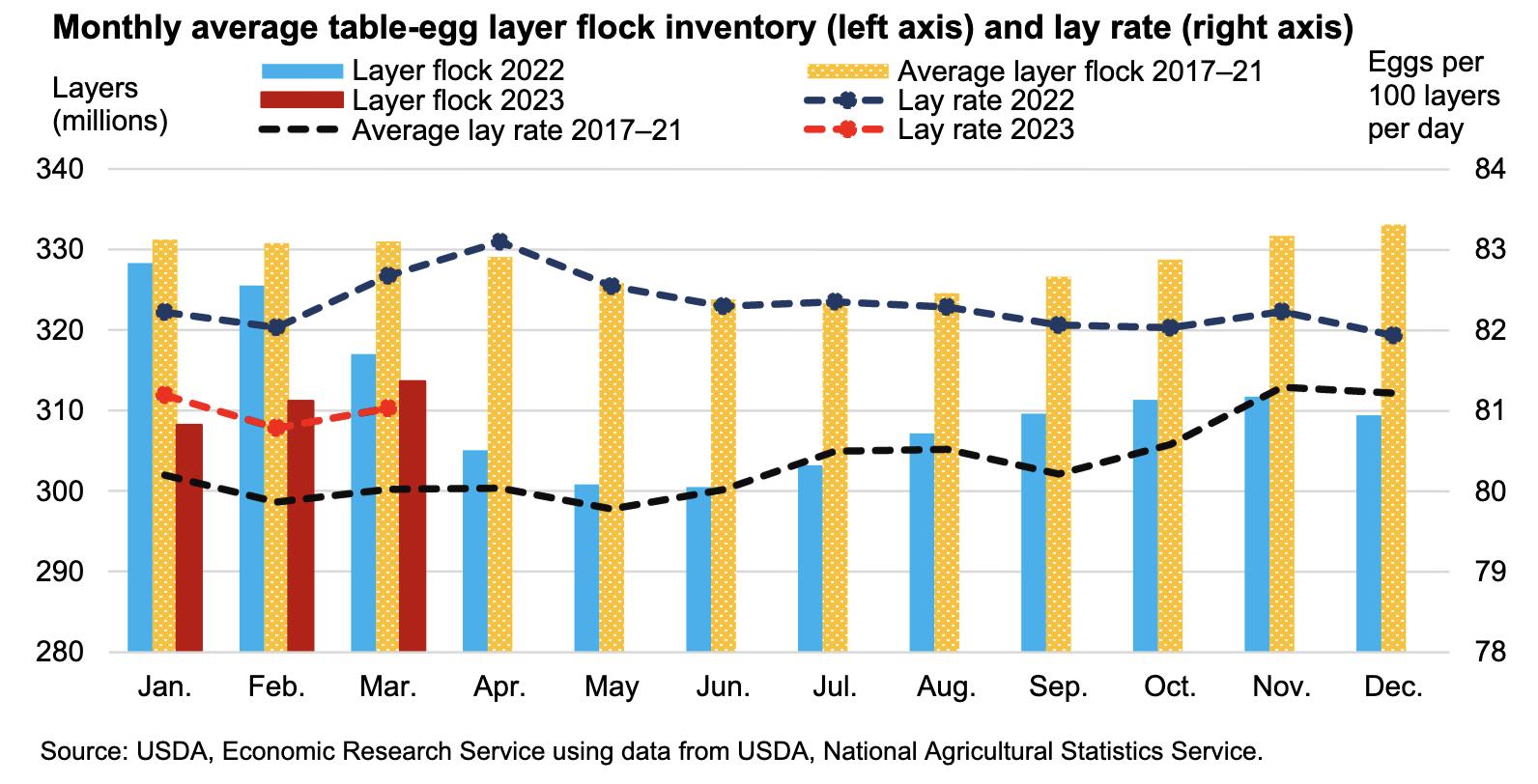

- It is now apparent that the inventory held by chains and other significant distributors may be more important over the short term in establishing wholesale price than the USDA regional inventory figures published weekly. This is probably the reason for fluctuation in weekly industry stock. It is evident that the USDA undercounted or incorrectly counted hens in the national flock leading up to Easter given the report of a 2.9 percent compensatory increase in the size of the national flock five weeks ago, accounting in part for sharply falling wholesale prices. This past week USDA published data placing the producing flock down less than 0.1 percent percent or 0.1 million hens to 307.5 million. This is a sharp contrast to the inexplicable reported rise of 5.0 million hens two weeks ago. This increase is inconsistent with the projected monthly projection of 21.9 million pullets reaching maturity during May or 5 million during the last week of this month. Given the latest figures it is estimated that the producing flock is still 10 to 12 million hens lower than before the onset of HPAI.

- Despite a lower flock size as a result of HPAI, relatively low unit revenue compared to pre-HPAI will now be a reality through June 2023. Sporadic outbreaks of HPAI are now unlikely given that the seasonal Spring migration of waterfowl is complete. The number and extent of future outbreaks during late fall and early winter of 2023 cannot be assessed until more information is available concerning the molecular and field epidemiology of 2022 spring and fall waves of HPAI. The USDA has yet to identify modes of transmission for the 2022 epornitic including airborne spread. The USDA-APHIS Center for Epidemiology released interim results of case-control studies on May 31st. This report failed to identify deficiencies in biosecurity on affected complexes that contributed to infection. APHIS has been remiss in collecting and evaluating available data and providing timely practical guidance on prevention. This is evidenced by releasing a backdated report during the first week of March 2023 and presenting a webinar on May 31st that were devoid of recommendations to prevent HPAI infection in flocks.

- The current relationship between producers and chain buyers based on a single commercial price discovery system constitutes an impediment to a free market. The benchmark price amplifies both downward and upward swings as evidenced over the past five weeks. A CME quotation based on Midwest Large, reflecting demand relative to supply would be more equitable. If feed cost is determined by CME ingredient prices then generic shell eggs should be subject to a Midwest Large quotation.

- According to the USDA the U.S. flock in production was down less than 0.1 percent or 0.1 million hens to 307.5 million during the week ending June 7th. The flock in production included about 3.0 to 4.0 million molted hens that resumed lay during the past week plus 4.0 to 5.0 million pullets attaining production.

- The ex-farm price for breaking stock was down 0.8 percent this past week to 57 cents per dozen. Checks delivered to Midwest plants were up 19.5 percent to 49 cents per dozen. Prices for breaking stock will remain low until there is a substantial increase in wholesale price.

The Week in Review

Prices

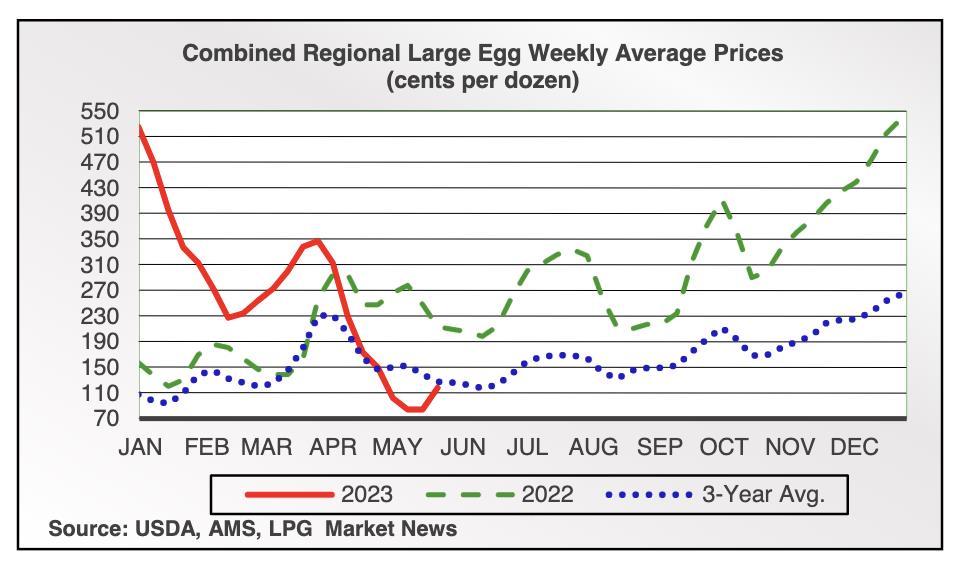

According to the USDA Egg Market News Reports released on June 5th the Midwest wholesale price (rounded to one cent) for Extra-large was unchanged from last week at $1.13 per dozen. Large size was also unchanged at $1.11 per dozen. The price for Medium size was unchanged at $1.01 per dozen as delivered to DCs. Prices should be compared to the USDA benchmark average 6-Region blended nest-run cost of 90.3 cents per dozen as revised by the EIC for April 2023. This excludes provisions for packing, packaging materials and transport, amounting to 47 cents per dozen in mid-2022, according to the EIC but now probably closer to 52 cents per dozen. Accordingly producers of generic shell eggs are operating with negative margins. The progression of prices during 2023 to date is depicted in the USDA chart reflecting three years of data, updated weekly.

The June 5th 2023 edition of the USDA Egg Market News Report documented a USDA Combined Region value rounded to the nearest cent, of $1.18 per dozen delivered to warehouses for the week ending May 29th 2023. This average price lags current Midwest weekly values by one week. The USDA Combined range for Large in the Midwest was $1.11 per dozen. At the high end of the range, the price in the South Central region attained $1.25 per dozen. The USDA Combined Price last week corresponded to the 3-year average of $1.35 per dozen. This past week Midwest Large was approximately $1.10 below the corresponding week in 2022 elevated by losses due to HPAI.

Flock Size

According to the USDA the number of producing hens reflecting June 7th (rounded to 0.1 million) was down 0.1 million hens (<0.1 percent) to 307.5 million. This is a sharp contrast to the apparent increase of 5.0 million two weeks ago coupled with an unrealistic increase of 8.6 million hens reported by the USDA five weeks ago. The total U.S. flock includes about 3.0 to 4.0 million molted hens due to return to production with approximately 4.0 to 5.0 million new pullets reaching maturity each week based on USDA monthly chick-hatch data for 20 weeks previously. The increase is offset by routine flock depletion in addition to residual losses during the fall 2022 phase of the 2022 HPAI epornitic. Based on inventory level and prices the hen population producing eggs should now be in relative balance with consumer demand. Industrial and food service off-take although increasing, has not reverted to pre-COVID levels. Prices will continue to fluctuate and are expected to stabilize at a low seasonal level through June 2023. Prices of shell eggs and products will also depend on any unlikely incident outbreaks of HPAI offset by the contribution of new pullets and of molted hens to supply.

According to the USDA the total U.S. egg-flock on June 7th was down 0.2 million hens (<0.1 percent) to 315.0 million including second-cycle birds and those in molt. Any difference between hens in production and total hens is an approximate figure but denotes that many molted hens resumed production in late May after a post-Easter molt. With lower benchmark wholesale prices older flocks have been molted or depleted. At present there are now at least 10 to 12 million fewer hens in both the total and producing flocks with the difference equivalent to about 3.5 percent of the pre-HPAI national flock of 325 million hens.

INVENTORY LEVELS

Cold storage stocks of frozen products in selected centers on June 5th 2023 amounted to 2.506 million pounds (1,139 metric tons) of frozen egg products, up 4.8 percent from the inventory of 2.391 million lbs. on May1st 2023. The monthly USDA Cold Storage Report below quantifies a reduction in the actual total stock level.

The most recent monthly USDA Cold Storage Report released on May 24th 2023 documented a total stock of 24.9 million pounds (11,337 metric tons) of frozen egg products on April 30th 2023. This quantity was up 11.2 percent from the April 30th 2022 value of 22.4 million pounds. April 30th 2023 frozen egg inventory was up 2.4 percent from the previous month ending March 31st 2023 attributed to presumably lower demand. Compared to April 30th 2022 yolk inventory was up 6.4 percent to 733 million lbs. on April 30th 2023.

A total of 88.1 percent of combined inventory (24.9 million lbs.) comprised the categories of “Whole and Mixed” (46.1 percent) and “Unclassified” (42.0 percent). The lack of specificity in classification requires a more diligent approach to enumerating and reporting inventory by the USDA

Shell Inventory

The USDA reported that the national stock of generic shell eggs effective June 5th 2023 was up a noteworthy 7.0 percent. The relative movement of stock over the past three weeks suggests increased consumer demand although retail prices are only now reflecting the sharp seasonal fall in wholesale price commencing seven weeks ago. Combined with breaking stock, the total inventory of shell eggs in the industry is now at 1.79 million cases (1.68 million last week and 103,200 cases higher). The U.S. population of laying hens at this time is influenced by the number of older birds previously culled during the fall phase of the 2022 HPAI epornitic and includes the population unaffected by HPAI, flocks retained after molting (with an anticipated decrease in this category based on price) and started pullets from chick placements in late December 2022. Going forward, younger hens will assume a larger proportion of the national flock as more flocks are placed compensating for the flocks depleted due to HPAI.

Five of six USDA Regions reported higher stock levels this past week. The regions are listed in descending order of stock: -

- The Midwest Region was up 8.4 percent compared to the previous week to 543,100 cases.

- The Southeast Region was up 3.9 percent to 282,100 cases

- The South Central Region was up 8.3 percent to 252,000 cases

- The Northeast Region was up 14.0 percent to 197,600 cases

- The Southwest Region was down 0.4 percent to 140,800 cases.

- The Northwest Region was up 3.6 percent to 87,500 cases

The total USDA six-area stock of commodity eggs comprised 1,788,100 cases, up 6.1 percent, of which 84.1 percent were shell eggs (83.4 percent last week, denoting similar demand to the previous week). The inventory of breaking stock was up 1.6 percent to 285,000 cases. Shell egg inventory was up 7.0 percent attaining 1,503,100 cases. The lower level of breaking stock over the past two weeks is attributed to a balance between increased conversion to egg powder and liquids for storage and export, diversion to the shell egg market and higher demand for liquids by industry, food service and consumers. The average price for Midwest checks and breaking stock combined was 47.5 percent of the average value of Midwest Extra-large and Large shell eggs (unchanged from last week) consistent with disproportionately lower prices for breaking stock and checks compared to shell eggs. The differential can be compared to 80.0 percent in April 2022 reflecting the initial period of high demand for both shell eggs and breaking stock after the onset of HPAI. This past week the wholesale Midwest Extra-large and Large shell egg prices were unchanged compared to the combination of breaking stock and checks that were up 18.6 percent on average from the previous week. This demonstrates the respective demands for shell eggs and egg products. There is interconnectivity of the packing and breaking segments of the egg industry under circumstances of extreme disturbances in either supply (lower due to HPAI in 2022) or demand (higher during COVID in 2020). The price for breaking stock and for checks is influenced by the relative demand for generic shell eggs and contract obligations with breakers.

On June 5th 2023 the inventory of other than generic eggs amounting to 481,500 cases (up 4.4 percent from last week at 461,100 cases) among three categories (with the previous week in parentheses) comprised: -

- Specialty category, up 5.1 percent to 48,300 cases. (Was up 7.1% to 46,000 cases)

- Certified Organic, up 3.9 percent to 105,900 cases. (Was up 7.4% to 101,900 cases)

- Cage-Free category, up 4.5 percent to 327,300 cases. (Was up 4.2 to 313,200 cases)

Demand for cage-free product will not increase materially over the long term while generic eggs from caged flocks and some surplus down-classified cage-free eggs are on the shelf at $2.20 to $2.50 per dozen during normal supply conditions. Currently there is a wide differential in shelf price between generics on the one hand and the considerably higher priced omega-3 enriched, cage-free and pasture-housed products. That the higher priced egg categories will lose demand is supported by the findings of the comprehensive review relating to the transition from cages to alternative systems.* Existing and proposed individual state legislation mandating sale of only cage-free eggs will support most of the completed and anticipated transition from cages but total re-housing will not be completed by the beginning of 2025, less than 17 months away and ultimately never as considered by most observers. The constitutional status of Proposition #12 was confirmed by SCOTUS in a May 11th 2023 decision with specific reference to the dormant Commerce Clause relating to interstate trade. Many chains are reneging on or extending their time commitments to achieve an acceptable transition to cage-free eggs. With the current proportion of non-caged flocks and lower prices for generic cage-derived eggs, cage-free eggs are surplus to demand in some areas. Cage-free eggs are becoming a commodity in many markets subjected to the same price pressures as generic eggs from caged hens. Growth in demand for organic product has been static for months and stock levels are rising. This past two weeks stock in this category exceeded 100,000 cases.

Long-term demand for cage-free eggs is influenced by the relative shelf prices of the category in comparison with generic white-shelled eggs from caged flocks. At the other end of the price range, consumers will purchase less-expensive brown cage-free product over organic eggs when there is a differential in price greater than about $1.20 per dozen under normal balance between supply and demand. Similarly, consumers will traditionally purchase white-shelled generic eggs in preference to brown-shelled cage-free with a differential of over $1.20 per dozen.

*Caputo,V. et al The Transition to Cage-Free Eggs. February 2023

A comprehensive structured market research project on cage-free eggs has provided an indication of consumer willingness to pay for this attribute. The industry requires a study on other aspects including shell color, GM status and nutritional enrichment. Above all, agricultural economists should evaluate the impact of disruption in supply and demand arising from large-scale depopulation following HPAI in 2015 and for the 2022 HPAI epornitic extending through restoration of hen numbers.

RELATIVE PRICES OF SHELL-EGG CATEGORIES

USDA-AMS posted the following national shell egg prices as available, for June 2nd 2023 in the Egg Markets Overview report for dozen cartons with comparable prices in parentheses for the previous week: -

Retail

Large, in cartons generic white: $1.18 up 15.7 percent ($1.02)

Large, in cartons cage-free brown: $2.63 down 6.7 percent ($2.82)

Large C-F, California in Cartons: $1.78 up 11.9 percent ($1.59)

Wholesale

National loose, (FOB dock): $0.85 down 6.5 percent ($0.91)

NYC in cartons to retailer: $1.25 unchanged ($1.25)

Regional in cartons to warehouse June 5th:

Midwest $1.11 up 26.1 percent ($0.88)

Northeast $1.16 up 27.7 percent ($0.93)

Southeast $1.21 up 23.5 percent ($0.98)

South Central $1.13 up 10.8 percent ($1.02)

Combined $1.18 up 24.2 percent ($0.95)

WEEKLY ADVERTISED PRICES OF SHELL-EGG CATEGORIES

USDA Certified Organic, Brown, Large: $5.38 (none)

Cage-Free Brown, Large: $3.81 ($3.99)

Omega-3 Enriched Specialty, White, Large: $3.18 ($3.29)

Generic White, Large Grade A $1.14 ($1.17)

Generic White, Large Grade A featured $1.18 ($1.032)

The advertised featured price posted for the week ending April 2nd for Large white grade A was $1.14 per dozen, down $0.03 per dozen or 2.9 percent from the previous week at $1.14 per dozen. Shelf prices will influence demand for generic categories given their availability and the comparison with higher advertised and actual shelf prices for specialty and cage-free brown eggs. Current supply was probably in balance with demand this past week as independent producers continue to divert shell eggs from breaking to market. Large integrated companies and packers continued to deliver to DCs at lower volumes as chains that held back on orders over five weeks in anticipation of lower benchmark prices were faced with the need to replenish store and DC inventories despite increasing benchmark prices.

For the current week the USDA posted a benchmark-advertised retail price for certified organic of $5.38. The USDA posted an advertised price of $3.81 per dozen for cage-free brown during the past week, down $0.18 per dozen or 4.5 percent lower than the previous week. Although week-to-week fluctuations can be expected in the stock of specialty and organic eggs based on the small base of these categories, there is a pronounced upward trend in inventory as price-conscious consumers buy power priced generics and caged eggs.

Cage-free brown at $3.81 per dozen was $0.80 per dozen higher than cage-free white at $3.01 per dozen.

Retail demand will continue to be supported by home cooking and baking and reinforced by seasonal dining out as COVID is now ignored. Eggs and product purchases will be limited among some demographics by their disposable incomes and inflation.

There was insufficient USDA data on shelf prices this week to calculate retail margins. Demand will increase as chains pass on any reduction in wholesale price for generic eggs. If subjective observation in stores operated by three retail chains in Durham, NC. are representative, retail margins ranged from 25 percent for a deep discounter to 75 percent for two national chains on the basis of carton-packed cost as delivered to DCs or for DSD with shelf prices of $1.90 to $2.40 per dozen for Large generic white. A deep discount chain is evidently passing on low prices to consumers with generic Large offered at $1.10 per dozen. Specialty eggs are still holding premium prices with omega-3 enriched at $4.95 per dozen, cage-free white at $4.50, organic at $7.00 and pasture-held at $8.50 in a national chain in Durham, NC.

Promotions this past week included certified organic at 4.0 percent of features. Omega-3 enriched comprised 11.0 percent of features (52.7 percent last week) with cage-free at 36.4 percent (35.5 percent last week). Large at 48.6 percent (11.8 percent last week) represented the only generic size featured. This confirms that retailers promote any category if available in excess of demand.

USDA Cage-Free Data

According to the latest monthly USDA Cage-free Hen Report released on June 1st 2023, the number of certified organic hens during May 2023 was unchanged from April 2023 at 18.2 million.

The USDA reported the cage-free (non-organic) flock in May 2023 was 0.2 percent higher than in April 2023 to 103.4 million

According to the USDA the population of hens producing cage-free and certified organic eggs in May 2023 comprised: -

Total U.S. flock held for USDA Certified Organic production = 18.2 million (17.3 million in Q1 2023).

Total U.S. flock held for cage-free production = 103.4 million (98.1 million in Q1 2023).

Total U.S. non-caged flock =121.6 million (115.4 million in Q1 2023).

This total value represents 37.4 percent (last month 36.9 percent) of a nominal 325 million total U.S. flock pre-HPAI (but 39.1 percent of the national flock after HPAI mortality to a late April complement of 310 million). Hens certified under the USDA Organic program have decreased in proportion to cage-free flocks since Q1 of 2021.

The accuracy of individual monthly values is questioned given a history of either sharp changes or no change in successive months as documented over the past two years. Precise quarterly reports would be more suitable for the industry in planning expansion and allocation of capital.

Processed Eggs

For the processing week ending June 3rd 2023 the quantity of eggs processed under FSIS inspection during the week as reported on June 7th 2023 was down 0.6 percent compared to the previous processing week to a level of 1,596,446 cases, (1,605,883 cases last week). The proportion of eggs broken by in-line complexes was 57.3 percent (55.2 percent in-line for the previous week) indicating a lower proportion of contract and purchased eggs broken. The differential in price for shell sales and breaking will determine the movement of uncommitted eggs. This past week 67.0 percent of egg production was directed to the shell market, (66.7 percent for the previous week) responding to the differential in prices paid by breakers and packers. Breaking stock inventory was up 1.6 percent this past week to 285,000 cases with diversion to shell-egg markets. Increased demand from QSRs and casual dining, with apparent continued demand from baking and eat-at-home has contributed to a lower inventory of breaking stock. During the corresponding processing week in 2021 (during COVID recovery) in-line breakers processed 47.4 percent of eggs broken.

For the most recent monthly report for week ending April 29th 2022, yield from 6,075,770 cases (7,007,366 cases last month) denoted a slight decrease in demand for liquid over the period April 2nd through April 29th 2023. Edible yield was 41.7 percent, distributed in the following proportions expressed as percentages: - liquid whole, 61.3; white, 23.7; yolk, 12.0; dried, 2.9.

All eggs broken during 2022 attained 76.22 million cases, 2.0 percent less than 2021. Eggs broken in 2023 to date amounted to 32,713,003 cases, 1.8 percent less than the corresponding period in 2022. This is attributed to a slight decrease in demand for egg liquids from retail, food service and QSRs and casual dining restaurants, although the differential is narrowing. The market is constrained by economic uncertainty with the ending of COVID supports, inflation, high credit card interest rates and purchasing of only essentials by consumers

PRODUCTION AND PRICES

Breaking Stock

The average rounded price for breaking stock was down 0.8 percent this past week to an average of 57 cents per dozen with an extreme range of 54 to 60 cents per dozen delivered to Central States plants on June 5th. Checks were up 18.7 percent this past week to an average of 49 cents per dozen over the most frequent range of 45 to 53 cents per dozen suggesting that the market for breaking stock has increased in parallel with shell eggs.

Shell Eggs

The USDA Egg Market News Report dated June 5th 2022 confirmed that Midwest wholesale prices for Extra-large, Large were unchanged from the previous week. Mediums were also unchanged. The trend of consecutive sharp lower prices ending with a plateau coupled with declining stock for over two weeks suggested that the market had bottomed. The increase this past week may be an anomaly attributed to chain buyers holding back on orders to reverse an upward move in the benchmark price. The following table lists the “most frequent” ranges of values as delivered to warehouses*: -

|

Size/Type

|

Current Week

|

Previous Week

|

|

Extra Large

|

111-114 cents per dozen

|

unchanged

|

|

Large

|

109-112 cents per dozen

|

unchanged

|

|

Medium

|

99-102 cents per dozen

|

unchanged

|

|

Processing:-

|

|

|

|

Breaking stock

|

54-60 cents per dozen

|

50-65 down 0.8%

|

|

Checks

|

53-45 cents per dozen

|

40-42 up 19.5%

|

*Store Delivery approximately 5 cents per dozen more than warehouse price

The June 5th 2023 Midwest Regional (IA, WI, MN.) average FOB producer price, for nest-run, grade-quality white shelled Large size eggs, with prices in rounded cents per dozen was unchanged from last week, (with the previous week in parentheses): -

EL. $0.96 ($0.96), (estimated by proportion): L. $0.93 ($0.93): M. $0.81 ($0.81)

The June 5th 2023 California price per dozen for cage-free, certified Proposition #12 compliant Large size in cartons delivered to a DC, (with the previous week in parentheses) was unchanged from last week.

EL. $1.87 ($1.92); L. $1.78 ($1.78); M. $1.65 ($1.68)

Shell-Egg Demand Indicator

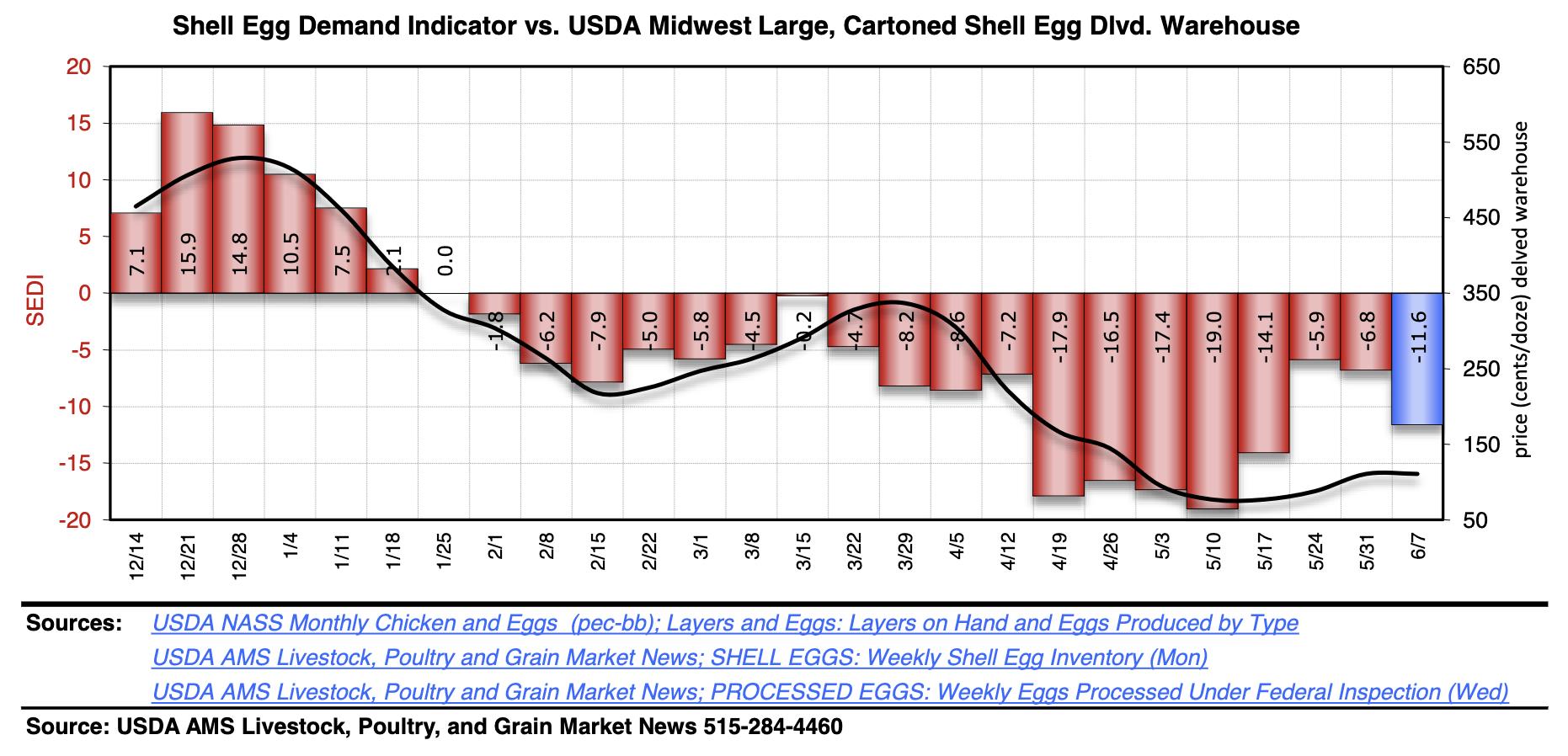

The USDA-AMS Shell Egg Demand Indicator for June 7th was down 4.8 points from the last weekly report to 11.6 with a 6.1 percent increase in total inventory and a 7.0 percent higher shell inventory from the past week as determined by the USDA-ERS as follows: -

|

Productive flock

|

307,463,578 million hens

|

|

Average hen week production

|

80.8% (was 80.6%)

|

|

Average egg production

|

248,537,554 per day

|

|

Proportion to shell egg market

|

67.0% (was 66.7%)

|

|

Total for in-shell consumption

|

462,318 cases per day

|

|

USDA Shell Inventory

|

1,503,100 cases

|

|

26-week rolling average inventory

|

4.56 days

|

|

Actual inventory on hand

|

5.16 days

|

|

Shell Egg Demand Indicator

|

-11.6 points (was -6.8 on May 31st 2023)

|

See the text, tables and figures and the review of production data and prices comprising the USDA Report for April 2023 and the 3rd Quarter FY 2023 results for Cal-Maine Foods under the Statistics Tab.

Dried Egg Products

The USDA extreme range in prices for dried albumen and yolk products in $ per lb. was released on June 2nd 2023. Data posted by the USDA is incomplete but available values are depicted for the past week and in parentheses for the previous week and also past months to illustrate the trend in prices influenced by HPAI depopulation and subsequent repopulation:-

|

Whole Egg

|

$7.50 to $9.00

(unchanged)

|

Average Feb. $11.08

March $11.75

April $11.28

May $ 9.15

|

|

Yolk

|

$5.85 to $7.55

($5.85 to $7.05)

|

Average Feb. $11.94

March $11.23

April $ 9.85

May $ 7.67

|

|

Spray-dried white

|

No quotation, past week

|

Average Dec. $14.18

Jan. $14.18

Feb-May. No release

|

|

Blends

|

No quotation, past week

|

|

Frozen Egg Products

The USDA range in prices for frozen egg products in cents per lb. on June 2nd 2023 compared to the previous week were on average higher, (Whole egg, -11.8%; White, unchanged; Yolks, -9.1%) but indicating a balance between available products and demand from the manufacturing and retail sectors: -

|

Whole Egg

|

$0.71 - $0.92

|

$0.70 - $1.15

|

|

White

|

$1.00 - $1.60

|

$1.00 - $1.60

|

|

Average for Yolks1

|

$2.08 - $2.30

|

$2.04 - $2.77

|

1. extreme range

May averages (April): Whole. $1.02, ($2.03); Whites, $1.40, ($1.94); Yolks, $2.46, ($3.06).

Liquid Egg Products

The May 2023 averages for non-certified truckload quantities are tabulated (per lb.) with April 2023 values in parentheses are: -

Whole, $0.63, (145c); Whites, $0.94 ($1.63); Yolks, $2.47, ($2.90).

The USDA has not released a report on dried egg inventory since March 13th 2020 due to inability to obtain data from producers, and will not issue reports for the immediate future.

COMMENTS

There have been no reports of commercial egg-producing or broiler flocks affected by HPAI outbreaks for five months. Cases as expected during the first quarter of 2023 did not materialize. For reasons yet to be understood only a few outbreaks have been recorded among turkeys and backyard farms year-to-date. Incident cases were diagnosed in the Maritime Provinces followed by Quebec and Ontario in Canada during April but without extension along the four North American Flyways and no incident cases in commercial flocks in May. It is evident that some wild domestic birds continue to shed virus based on cases in backyard flocks. This situation requires more intensive monitoring including surveys of wild domestic birds and small mammals. Given the risks and consequences of infection it will be necessary to maintain high levels of structural and operational biosecurity.

To date approximate losses in commercial flocks with confirmed HPAI and updates include:-

- 2,900,000 broilers on 18 farms in 7 states For 2023 to date losses are 450,000

- 330,000 broiler breeders on 11 farms in 6 states.

- 9,900,000 turkeys including a few breeder flocks on 231 farms in 7 states. For 2023 to date losses are approximately 250,000 with two incident cases in the Dakotas durin mid-May.

- 44,000,000 egg-production hens in total with 95 percent on 22 large complexes above 0.5 million in addition to 1,070,000 pullets with a total of 41 locations in 11 states. Pullet mortality does not include “at risk” replacements depleted on affected complexes with contiguous pullet rearing.

For calendar 2022 through March 28th 2023, 323 U.S. commercial U.S. flocks were infected with five of these occurring during March. In addition there were 493 diagnosed backyard flocks with 34 during March. Losses of among commercial species have totaled 58.6 million commercial birds. (Reported to WOAH). To date 47 states, involving 400 counties have recorded at least one case involving wild birds, backyard flocks, commercial farms or their combination.

Mexico has depopulated 5.5 million commercial poultry, predominantly egg-producing flocks. One million have been depleted year-to-date

From April 2022 through mid-April 2023, Canada recorded 309 outbreaks in commercial flocks in nine Provinces and has depopulated 7.3 million commercial poultry including hens, turkeys and broilers. In addition numerous confirmations of HPAI were made in backyard and subsistence flocks.

During May 2023 cases of H5N1 with Eurasian genes were diagnosed in either raptors or waterfowl in eight states extending from Oregon East to New York and from North Dakota south to Arizona denoting widespread dissemination of HPAI H5N1virus. Isolation of H5N1 avian influenza in wild birds and backyard flocks is a function of surveillance intensity

Collectively the USMCA nations have depopulated approximately 70 million birds in at least 900 flocks.

France and Holland have evaluated AI vaccines with success. Mexico and Egypt have introduced vaccination. An International conference on vaccination against HPAI took place in Paris on October 25th and 26th and recognized unjustified trade barriers as obstacles to adoption of vaccination.

Backyard flocks that are allowed outside access will continue to be at risk of infection in the U.S. These small clusters of birds in suburban areas are of minimal significance to the epidemiology of avian influenza as it affects the commercial industry. Backyard flocks serve as indicators of the presence of virus among free-living birds as evidenced by ongoing outbreaks in commercial poultry flocks across the U.S.

The level of biosecurity in commercial egg production complexes and broiler farms is appreciably higher than in 2015 when the U.S. experienced an epornitic along the Mississippi Flyway The response of state and federal authorities since this time has been rapid and effective both in diagnosing and depleting affected flocks possibly preventing lateral spread. To date, all floor-housed flocks that were infected were depopulated using foam. Euthanasia of egg production complexes involved various combinations of VSD+ applying heat or carbon dioxide or conventional kill-carts flushed with carbon dioxide.

The role of migratory waterfowl in introduction and subsequent dissemination of H5N1 HPAI virus is indicated by the close proximity of infected complexes and their counties with major waterways, lakes, wetlands or reservoirs during the spring and fall months of 2022. There is now limited subjective evidence of aerogenous transmission of HPAI over short distances with virus (possibly shed by wild endemic and migratory birds) becoming entrained in dust and introduced into ventilation inlets by powered ventilation systems.

It would have been of practical and financial benefit for APHIS epidemiologists to have reported on their findings from the questionnaires completed following outbreaks on commercial farms during the first quarter of 2022. Given the costs to the private and public sectors and to consumers priority should have been extended to the first seven large egg complexes affected. Case-comparison studies against representative unaffected complexes should have been performed using specific and relevent questionnaires. This would have provided advice to producers on risk factors.

A preliminary opinion with guidance during mid-April 2022 concentrating on large egg complexes was not an unrealistic request. This is especially the case since large egg complexes in Northwest Ohio and in Colorado were infected during September, in Iowa in October and again in November and in Oregon and South Dakota during early December 2022. This suggests ongoing exposure from wild domestic birds and possibly mammals in addition to migratory waterfowl as evidenced by the increasing incidence in backyard flocks that effectively serve as sentinels. An interim report was released during the first week of March 2023, inexplicably backdated to July 2022. This document, lacking either conclusions or recommendations was critiqued in a special edition of EGG-NEWS on March 8th.

The USDA-APHIS presented a webinar to review the results of epidemiologic studies on May 31st. The data presented failed to provide any practical or applicable recommendations to reduce infection based on limited numbers of flocks incorporated into a case-control study applying a dated and presumably inappropriate questionnaire administered by telephone survey.