Following eleven successive increases in the 10-year benchmark interest rate the FOMC engineered a reduction in U.S. inflation as measured by the Consumer Price Index (CPI) from 8.9 percent in June 2022 to 3.5 percent in March 2024. The increase in the benchmark interest rate did not result in unemployment and many influential economists predict a “soft landing”.

Following eleven successive increases in the 10-year benchmark interest rate the FOMC engineered a reduction in U.S. inflation as measured by the Consumer Price Index (CPI) from 8.9 percent in June 2022 to 3.5 percent in March 2024. The increase in the benchmark interest rate did not result in unemployment and many influential economists predict a “soft landing”.

Despite the substantial increase in the inflation rate, attaining an elusive FOMC inflation target of approximately 2.0 percent will be difficult to accomplish. At the beginning of year, the market anticipated as many as six reductions in interest rates. The five consecutive pauses suggested caution and based on CPI, wage and employment data there will probably be only one or two reductions of 0.25 percent each in 2024 and not before late summer. Federal Reserve Chairman Powell, supported by Federal Reserve Governors, has stated in Congressional testimony and in public statements that decisions on reducing interest rates would be based on data with demonstrable progress in reducing inflation.

Energy is a major contributor to “sticky” inflation having increased by close to 25 percent since December 2023. Although turbulence in the Middle East could have been a significant factor in the increase, effectively disciplined restriction in output by OPEC+ has maintained price above $80 per barrel. As noted in successive weekly Economy, Energy and Commodity Reports in EGG-NEWS, the November reduction in OPEC+ output of 2.2 million barrels a day was extended through June representing two percent of global production. Non-OPEC output including Brazil, Angola and the U.S. has in large measure moderated the effect of the OPEC+ constraints. OPEC+ has learned that high oil prices reduce demand, and the Cartel has acquired the skill and discipline to fine-tune supply to regulate price and to disfavor alternative sources of energy.

Restoration of the economies of the E.U. and China, concurrent with increased industrial activity, will however create further demand for crude and other forms of non-renewable energy with valid predictions of a rise in price. Despite the reciprocal mutual attacks by Israel and Iran during the current month, the Brent Crude benchmark is still below $90 per barrel compared to a high of $95 in August 2023 and a recent low of $75 per barrel during November 2023. Economists predict that if OPEC cuts hold, Brent Crude could reach $100 per barrel by mid-summer attributed to increased demand.

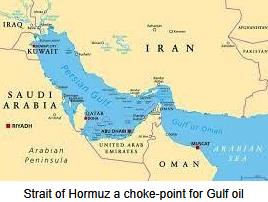

Unknowns relating to future oil supply and prices will be influenced by possible reaction by Iran. Obviously increased sanctions against the regime will evoke a response either by the rulers of that nation or their surrogates. Interdicting transport of crude through the straits of Hormuz or additional action by Houthi rebels in the Bab-el-Mandeb strait could drive oil above $100 per barrel. This would result in international action including pressure by China, the major purchaser of Iranian oil. Given recent history, it is anticipated that Brent Crude will fluctuate between $85 and $90 per barrel though summer. Availability of domestic supply in the U.S. will probably constrain WTI crude at between $82 and $87 per barrel but higher prices will favor increased exports.

Since the price of oil is closely correlated with corn and other agricultural commodities, any escalation in price has implications for livestock production. Higher prices for diesel and gasoline will limit consumer spending with a negative effect on the earnings of food producers, distributors and retailers. According to the American Automobile Association

U.S. consumers paid on average, $3.66 per gallon for regular grade during mid-April.

It is axiomatic that the pump price of gasoline will influence the November election with high prices attributed to the incumbent party, irrespective of justification.