A recent posting by Brian Earnest of CoBank indicated that egg prices would remain high for a considerable period. He based his conclusion on the current reduced flock size following depletion of close to 42 million laying hens. Prices are also fueled by increased demand as consumers move down the protein chain and find value in eggs, even at current prices. Earnest correctly cites current USDA data, including the Weekly Shell Egg Demand Indicator, monthly stock levels and the trend in prices.

Based on USDA hatch figures, the U.S. laying flock will soon increase since there are approximately 4 million pullets each week ready to commence production, hatched between five and six months ago. The rate of losses attributed to HPAI fluctuates as documented each week in the EGG-NEWS Weekly Egg Price and Inventory Report but has now moderated in the egg sector.

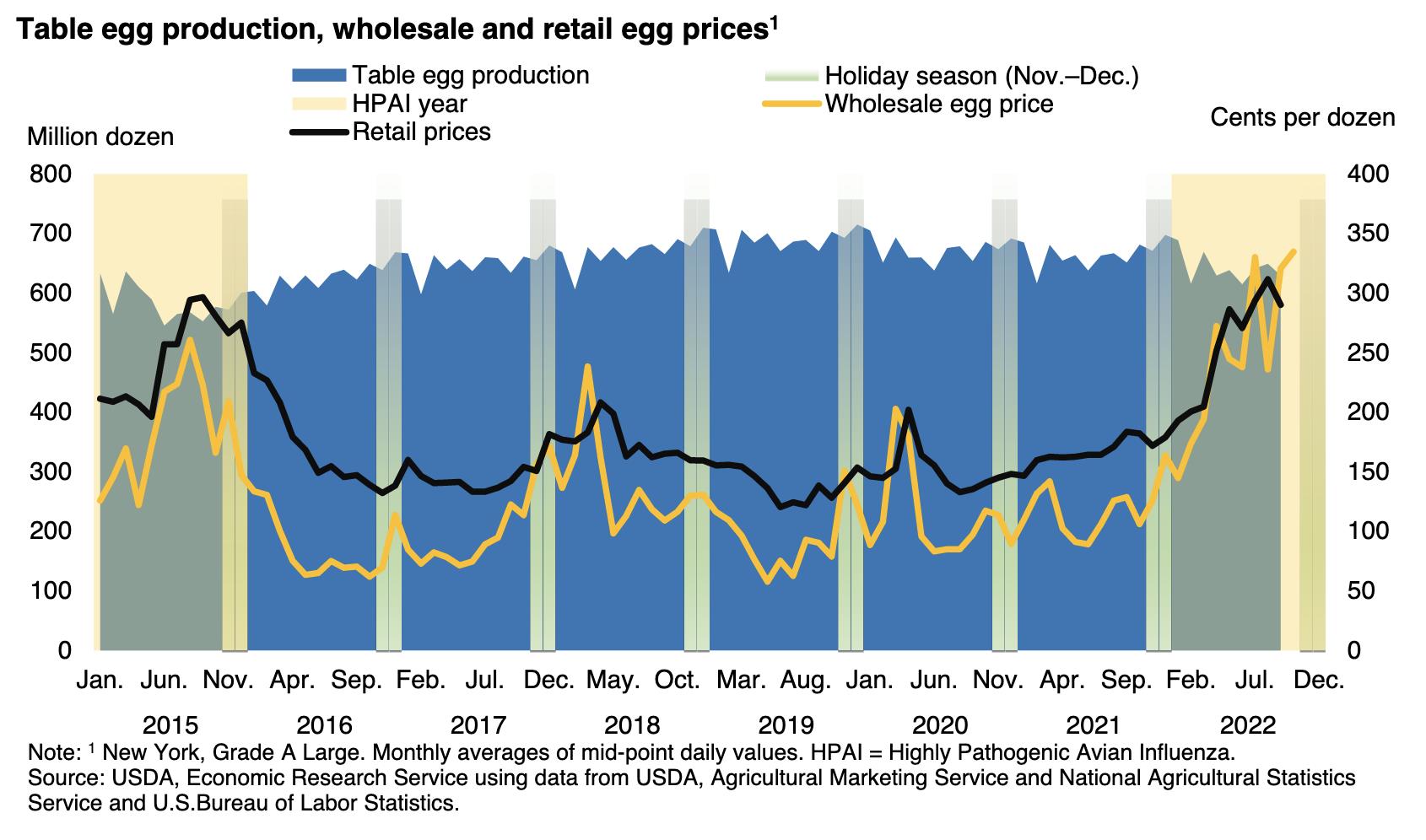

Reviewing the recovery of the U.S. flock after the 2015 epornitic suggests that a similar situation will be repeated in 2023 as pullets commence production, laying cycles are extended and a higher proportion of hens are molted providing that housing is available. Reference to USDA data shows the effect on wholesale price of an increase in production in accordance with the law of supply and demand.

Currently, there are between 18 and 20 million fewer hens in the national producing flock. If losses, due to HPAI remain at the current incidence rate, the industry could easily compensate for past losses through placement of pullets already in the pipeline and from ongoing placements by mid-second quarter. Restoration and even overcompensation could be achieved with careful control of flock size and through application of molting as occurred in 2016. The current nosebleed prices will soon respond to increased production, amplified downward by the benchmark pricing system that will be exploited by buyers.

Currently, there are between 18 and 20 million fewer hens in the national producing flock. If losses, due to HPAI remain at the current incidence rate, the industry could easily compensate for past losses through placement of pullets already in the pipeline and from ongoing placements by mid-second quarter. Restoration and even overcompensation could be achieved with careful control of flock size and through application of molting as occurred in 2016. The current nosebleed prices will soon respond to increased production, amplified downward by the benchmark pricing system that will be exploited by buyers.