The Paycheck Protection Program signed into law as the CARES Act on March 27th 2020 with $349 billion in funding obviously assisted small businesses to remain in operation but unfortunately attracted fraudsters. Recently ProPublica investigated Kabbage, an online lending platform that was negligent in processing loans for non-existent businesses. Many of the fraudulent applications claimed to be agricultural enterprises. It is estimated that the Small Business Administration approved loans for 55,000 ineligible businesses and that overpayments were extended to 43,000 applicants. The Department of Justice is reviewing the more egregious cases for criminal action.

The Paycheck Protection Program signed into law as the CARES Act on March 27th 2020 with $349 billion in funding obviously assisted small businesses to remain in operation but unfortunately attracted fraudsters. Recently ProPublica investigated Kabbage, an online lending platform that was negligent in processing loans for non-existent businesses. Many of the fraudulent applications claimed to be agricultural enterprises. It is estimated that the Small Business Administration approved loans for 55,000 ineligible businesses and that overpayments were extended to 43,000 applicants. The Department of Justice is reviewing the more egregious cases for criminal action.

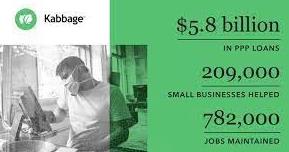

The ProPublica investigation demonstrated that Kabbage operated with minimal oversight of requests. Their remuneration was based on a fee for each loan processed. This payment structure essentially incentivized the Company into throwing money at any applicant. More conservative and conventional banks declined loans that were advanced by Kabbage and other Fintech enterprises that were lightly regulated. Kabbage and other loan processors received a fee of five percent on loans under $350,000 representing most of the transactions. It is estimated that Kabbage processed 300,000 loans amounting to $7 billion. In August 2020 Kabbage was acquired by American Express.

ProPublica documented questionable practices in evaluating loans, 75 percent of which were approved without review, providing application forms were fully completed. In response to a deluge of applications, Kabbage apparently employed reviewers with inadequate or non-existent training who were provided with incentives to expedite and approve loans. It is unfortunate that a program that was established as an emergency response to a major economic downturn was highjacked by criminals and fraudsters and facilitated by the mendacity of lending institutions acting on behalf of the Federal government.