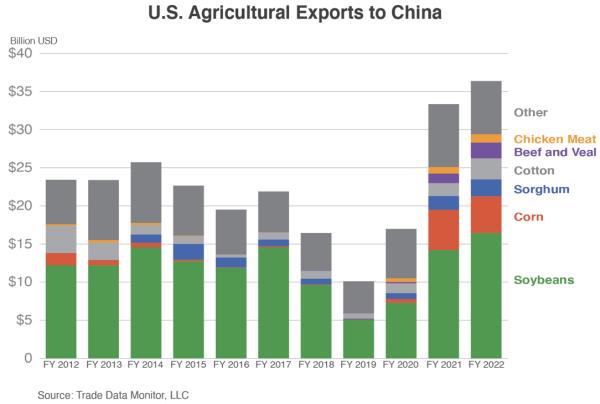

China is a significant importer of U. S. agricultural products. Demand from this trade partner supports the market for soybeans and corn, maintaining relatively higher prices than would otherwise prevail, reflected in feed cost and hence margin. In contradistinction, China imports poultry, pork and beef from the U.S., reducing supply relative to demand and thereby maintaining revenue and margin based on domestic prices for livestock products. For U. S. fiscal 2022, all agricultural exports to China attained $36.4 billion. The major exports included:-

- Soybeans, $16 billion out of total imports by China of $32 billion.

- Corn, $5 billion out of $20 billion imported.

- Beef, $2 billion out of $12 billion.

- Pork, $1 billion out of $7 billion.

- Poultry, predominantly feet (66 percent) and leg quarters, $1 billion out of $6 billion.

For comparison the USDA-WASDE #639, released on August 11th, projects soybean exports to attain 1,825 million bushels representing 40.6 percent of total supply for the 2023 harvest. Total corn exports will rise to 2,050 million bushels corresponding to 12.4 percent of total supply.

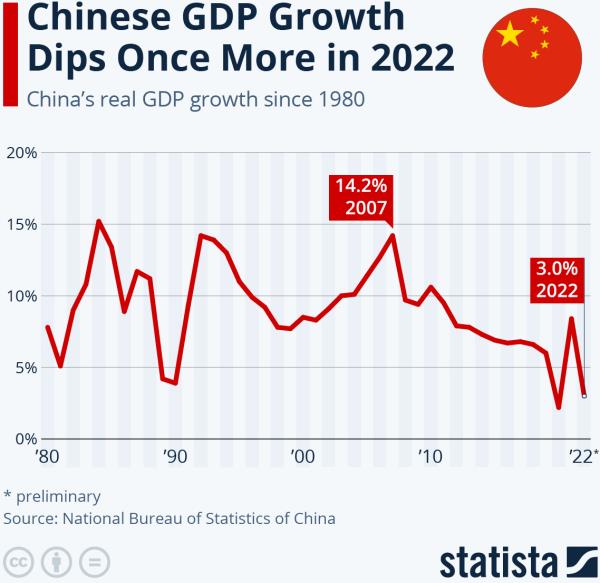

The economy of China as a “Communist Peoples Republic” is controlled by the central government. Bureaucrats in large measure determine the volume of imports and their origin with emphasis on needs, price and political considerations. China has yet to recover from the extreme COVID restrictions and will not achieve the previously stated and aspirational GDP growth target of 5 percent during 2023. In contrast to the developed world, China is experiencing deflation with consumer prices 0.3 percent lower in July compared to the corresponding month in 2022. The Producer Price Index has declined on an annual basis for ten consecutive months.

|

Export value declined by ten percent in July and the Goods and Services Index fell by 1.4 percent in the second quarter compared to a year previously. Property sales in the 30 largest cities fell by 28 percent in July compared to 2022. Major property developers that operate government-tolerated Ponzi schemes including Country Garden and Evergrande have experienced cash flow crises with the former company facing meltdown and the latter defaulting on loan repayments.

Faced with the realities of a faltering economy and with prospects for public disaffection, the Government has unveiled measures to improve consumption. Private enterprise will again be encouraged, and labor mobility will be eased. Unfortunately, the central bank of China is not aggressively trimming interest rates and is maintaining an unrealistic short-term value of two percent. This contrasts with the period of COVID restrictions when real interest rates were at a negative three percent and consumer prices were up by five percent. The gross domestic product for China is estimated at 6.3 percent for the second quarter, down considerably on an earlier anticipation of a recovery following COVID restrictions. Over 52 weeks, Chinese currency has declined by 6.9 percent against the U.S. dollar.

The decline in growth and economic opportunity is reflected in the rise in youth unemployment estimated at over 20 percent with more than half of those seeking work comprising recent graduates of universities. This situation is so embarrassing to the Government that the Bureau of Statistics has stopped publishing data on unemployment for those under 30 years of age and has ceased releasing consumer-confidence indexes since mid-year. Domestic tourism is at a low level despite government stimulus and foreign tourism has evaporated. In the absence of well-paying jobs, young citizens of China are unable to afford housing and are delaying marriage. This has exacerbated the decline in population. Couples are reducing family size based on the high cost of raising and educating children especially in cities. It is estimated that currently the average of 1.1 births per woman of childbearing age is far below the 2.1 required to maintain a working population over the long term.

Antagonism between the U. S. and China in geopolitical competition is impacting sales of U. S. agricultural products due to the round of countervailing import duties imposed by both nations. Availability and price of soybeans from Brazil and grains from Russia are landed at lower prices than U. S. equivalents. This trend will persist. The fact that Cargill disposed of poultry assets in China and that Tyson Foods is following a similar path and lower revenue and earnings posted by the WH Group suggests that the decline in the economy in China confirms an unprofitable future for livestock production.

|

For the first six months of 2023, broiler exports to China were down by 13.2 percent by volume and 29.5 percent by value compared to the first half of 2022. Volume and value of broiler exports to China represented 13.2 percent and 16.8 percent of U.S. shipments respectively. The average unit price for all broiler exports to China in 2022 was $1,747 per ton compared to $1,638 per metric ton for the first half of 2023. For the first six months of 2023, China imported 244,982 metric tons of poultry products valued at $401,295. These values were down 22.5 percent and 29.5 percent, respectively from the first half of 2022. Of the 2023 first-half total value of broiler exports, 65.7 percent comprised feet and paws with a unit price of $1,804 per metric ton, down 11.6 percent from $2,041 per metric ton in 2022.

Clearly, the economy of China over the proximal three years will have a considerable impact on U. S. agriculture and the broiler industry. Decreased demand for corn and soybeans will reduce domestic production cost to the advantage of U. S. integrators. Unfortunately, reduced demand for pork and broiler meat in China will accelerate the decline in exports requiring compensatory increases in supply to existing and new import customers. This will, however, necessitate a radical approach to product scope extending beyond bulk leg quarters. But that is a topic for a subsequent editorial.