Following the March 11th signing of the COVID-19 Stimulus Act, the Administration will embark on an ambitious program to restore the economy. The legislation is apparently supported by 70 percent of citizens surveyed although the vote in both the House and Senate was based on party affiliation. Passage was facilitated by deletion of a provision mandating an increase in the Federal minimum wage to $15 per hour. The principal thrust of the Act is to expedite recovery from COVID, regarded as the major obstacle to economic recovery.

Following the March 11th signing of the COVID-19 Stimulus Act, the Administration will embark on an ambitious program to restore the economy. The legislation is apparently supported by 70 percent of citizens surveyed although the vote in both the House and Senate was based on party affiliation. Passage was facilitated by deletion of a provision mandating an increase in the Federal minimum wage to $15 per hour. The principal thrust of the Act is to expedite recovery from COVID, regarded as the major obstacle to economic recovery.

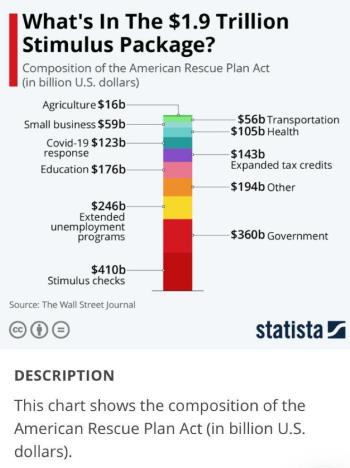

The direct COVID-related provisions include $160 billion for vaccination and testing programs; $10 billion for purchases under the Defense Production Act for PPE, vaccines, and tests for COVID; $200 million for the Department of Labor to carry out worker protection activities; $170 billion for schools to reopen and additional health coverage and leave benefits for people affected by COVID.

The direct COVID-related provisions include $160 billion for vaccination and testing programs; $10 billion for purchases under the Defense Production Act for PPE, vaccines, and tests for COVID; $200 million for the Department of Labor to carry out worker protection activities; $170 billion for schools to reopen and additional health coverage and leave benefits for people affected by COVID.

The Act directs payments of $1,400 per eligible person to compensate for losses sustained as a result of COVID and to stimulate the economy. For those who are unemployed, mainly as a result of COVID, unemployment insurance including a $300 per week supplement would be paid through September 6th extending the House version that expired on March 14th. Concurrently, tax credits would be extended to low and middle-income families and child tax credits would be expanded for 2020. The USDA will receive $4 billion for commodity purchases and distribution of food. The USDA has unveiled a series of measures to enhance SNAP and EBT benefits.

State and local governments have suffered as a result of lower tax revenue and accordingly the Stimulus Act assigns $360 billion to allow continuation of services critical to maintaining an orderly society. Homelessness has increased twofold during the COVID pandemic and a moratorium on evictions has prevented additional suffering, but the stimulus bill includes $45 billion for rental assistance. To assist in an economic recovery, $25 billion will be set aside for small restaurants, $23 billion for airlines and airports, and $23 billion for small businesses under the Economic Injury Disaster Loans and Paycheck Protection program.

The measures contained in the Stimulus Act will only have a beneficial effect if funds are distributed equitably with appropriate control to minimize inevitable fraud and wastage.

Some economists, in their inimitable way, have taken opposing views on the value of the stimulus plan. Cautious commentators including Dr. Larry Summers maintain that injecting $1.9 trillion into the economy will result in inflation. Others consider that without adequate support, recovery will be delayed, reminiscent of the Great Depression of the 1930s. The intent of the federal government is to apply all possible measures to reduce the impact of COVID on the population and hence the economy. The stimulus package can be regarded either as a giant giveaway that will burden succeeding generations with debt or represents a bold initiative to reestablish the U.S. economy.

Some economists, in their inimitable way, have taken opposing views on the value of the stimulus plan. Cautious commentators including Dr. Larry Summers maintain that injecting $1.9 trillion into the economy will result in inflation. Others consider that without adequate support, recovery will be delayed, reminiscent of the Great Depression of the 1930s. The intent of the federal government is to apply all possible measures to reduce the impact of COVID on the population and hence the economy. The stimulus package can be regarded either as a giant giveaway that will burden succeeding generations with debt or represents a bold initiative to reestablish the U.S. economy.

Expenditure under the Act will however be useless without effectively suppressing COVID through vaccination and commonsense precautions. Accepting the safety and effectiveness of the three approved COVID vaccines and complementary measures to prevent infection, including masking and social distancing should be regarded as patriotic endeavors directed to recovery. Ending COVID is essential to achieving a low single-digit growth in GDP in 2021. Without appropriate public support, the $1.9 trillion will simply be a stopgap measure and will not have the intended restorative effect on our economy.